Question: Please show every step on how you got each answer Including if you used excel. If correct ill thumbs up if wrong ill leave blank.

Please show every step on how you got each answer Including if you used excel. If correct ill thumbs up if wrong ill leave blank. idk how to comment but if you know how please let me know that was if part of its correct i can comment that.

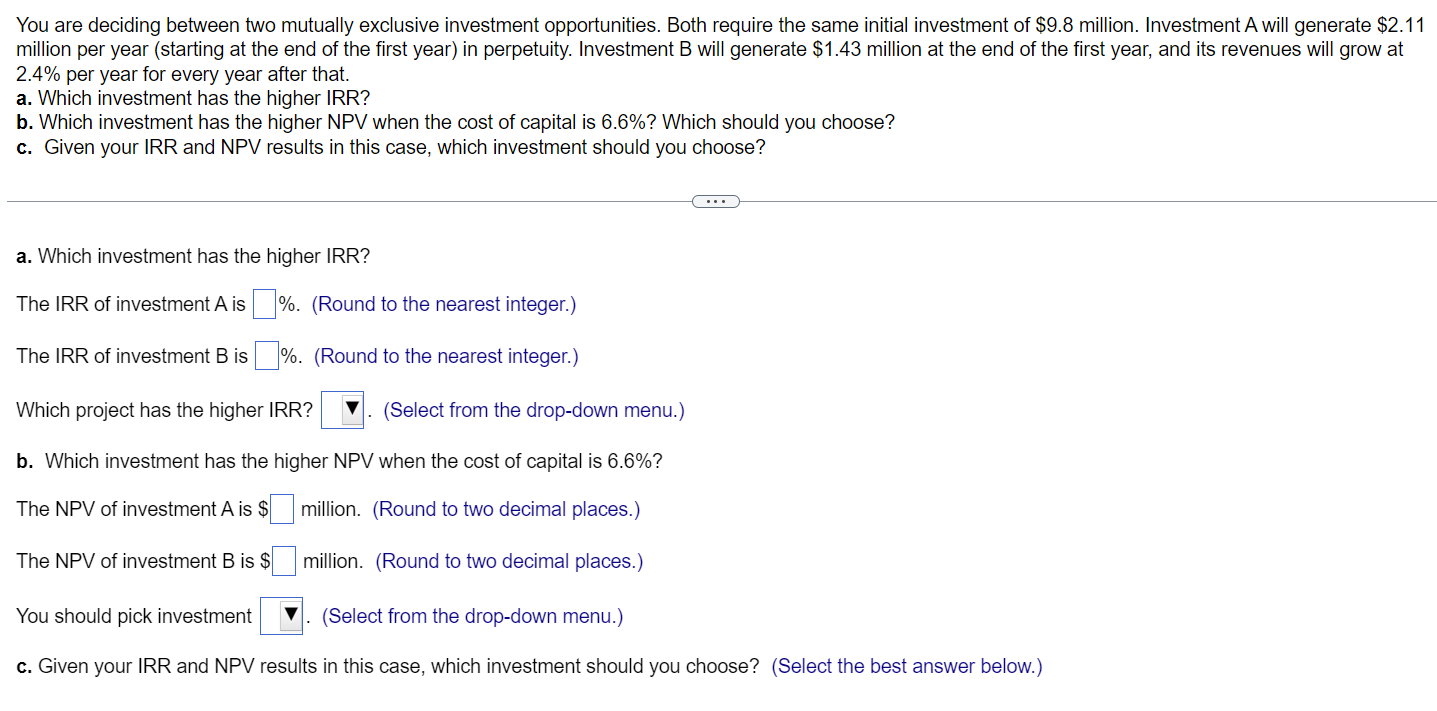

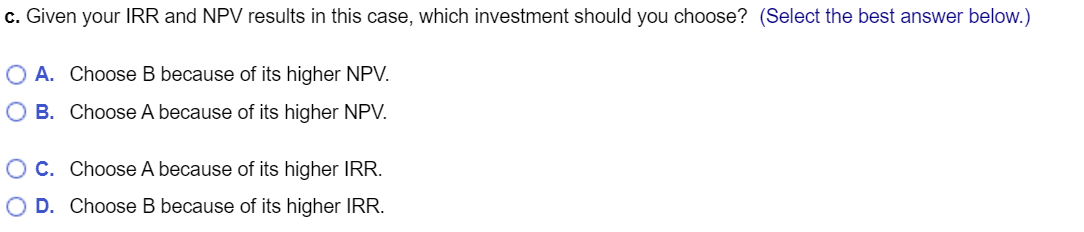

You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $9.8 million. Investment A will generate $2.11 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.43 million at the end of the first year, and its revenues will grow at 2.4% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 6.6% ? Which should you choose? c. Given your IRR and NPV results in this case, which investment should you choose? a. Which investment has the higher IRR? The IRR of investment A is %. (Round to the nearest integer.) The IRR of investment B is %. (Round to the nearest integer.) Which project has the higher IRR? (Select from the drop-down menu.) b. Which investment has the higher NPV when the cost of capital is 6.6% ? The NPV of investment A is $ million. (Round to two decimal places.) The NPV of investment B is $ million. (Round to two decimal places.) You should pick investment . (Select from the drop-down menu.) c. Given your IRR and NPV results in this case, which investment should you choose? (Select the best answer below.) A. Choose B because of its higher NPV. B. Choose A because of its higher NPV. C. Choose A because of its higher IRR. D. Choose B because of its higher IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts