Question: Please show excel Abbott placed into service a flexible manufacturing cell costing $840,000 early this year. They financed $425,000 of the initial cost of the

Please show excel

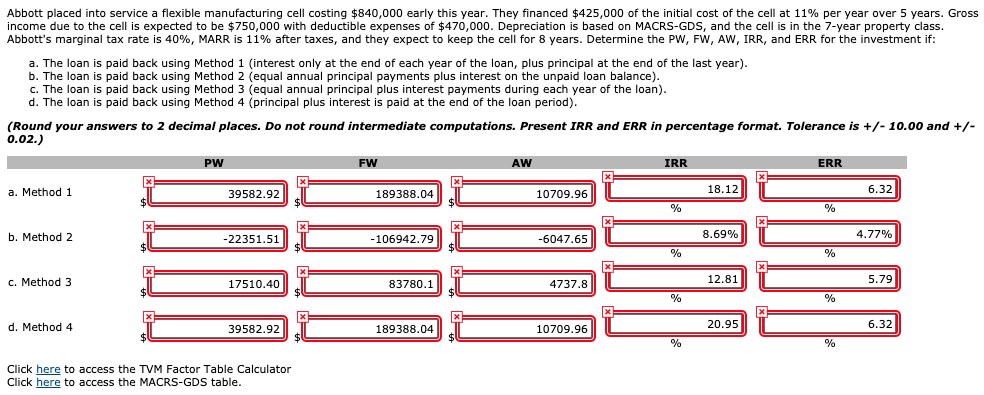

Abbott placed into service a flexible manufacturing cell costing $840,000 early this year. They financed $425,000 of the initial cost of the cell at 11% per year over 5 years. Gross income due to the cell is expected to be $750,000 with deductible expenses of $470,000. Depreciation is based on MACRS-GDS, and the cell is in the 7-year property class. Abbott's marginal tax rate is 40%, MARR is 11% after taxes, and they expect to keep the cell for 8 years. Determine the PW, FW, AW, IRR, and ERR for the investment if: a. The loan is paid back using Method 1 (interest only at the end of each year of the loan, plus principal at the end of the last year). b. The loan is paid back using Method 2 (equal annual principal payments plus interest on the unpaid loan balance). c. The loan is paid back using Method 3 (equal annual principal plus interest payments during each year of the loan). d. The loan is paid back using Method 4 (principal plus interest is paid at the end of the loan period). (Round your answers to 2 decimal places. Do not round intermediate computations. Present IRR and ERR in percentage format. Tolerance is +/- 10.00 and +/- 0.02.) PW FW AW IRR ERR X a. Method 1 18.12 39582.92 189388.04 10709.96 6.32 % % X X b. Method 2 -22351.51 -106942.79 -6047.65 8.69% 4.77% % % X X X c. Method 3 17510.40 83780.1 4737.8 12.81 5.79 % % x d. Method 4 20.95 39582.92 189388.04 10709.96 6.32 % % Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. Abbott placed into service a flexible manufacturing cell costing $840,000 early this year. They financed $425,000 of the initial cost of the cell at 11% per year over 5 years. Gross income due to the cell is expected to be $750,000 with deductible expenses of $470,000. Depreciation is based on MACRS-GDS, and the cell is in the 7-year property class. Abbott's marginal tax rate is 40%, MARR is 11% after taxes, and they expect to keep the cell for 8 years. Determine the PW, FW, AW, IRR, and ERR for the investment if: a. The loan is paid back using Method 1 (interest only at the end of each year of the loan, plus principal at the end of the last year). b. The loan is paid back using Method 2 (equal annual principal payments plus interest on the unpaid loan balance). c. The loan is paid back using Method 3 (equal annual principal plus interest payments during each year of the loan). d. The loan is paid back using Method 4 (principal plus interest is paid at the end of the loan period). (Round your answers to 2 decimal places. Do not round intermediate computations. Present IRR and ERR in percentage format. Tolerance is +/- 10.00 and +/- 0.02.) PW FW AW IRR ERR X a. Method 1 18.12 39582.92 189388.04 10709.96 6.32 % % X X b. Method 2 -22351.51 -106942.79 -6047.65 8.69% 4.77% % % X X X c. Method 3 17510.40 83780.1 4737.8 12.81 5.79 % % x d. Method 4 20.95 39582.92 189388.04 10709.96 6.32 % % Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts