Question: Please show excel calculations 3. Bond Valuation Given the purchase prices, coupons and maturities of four bonds, calculate the yields to maturity to you, the

Please show excel calculations

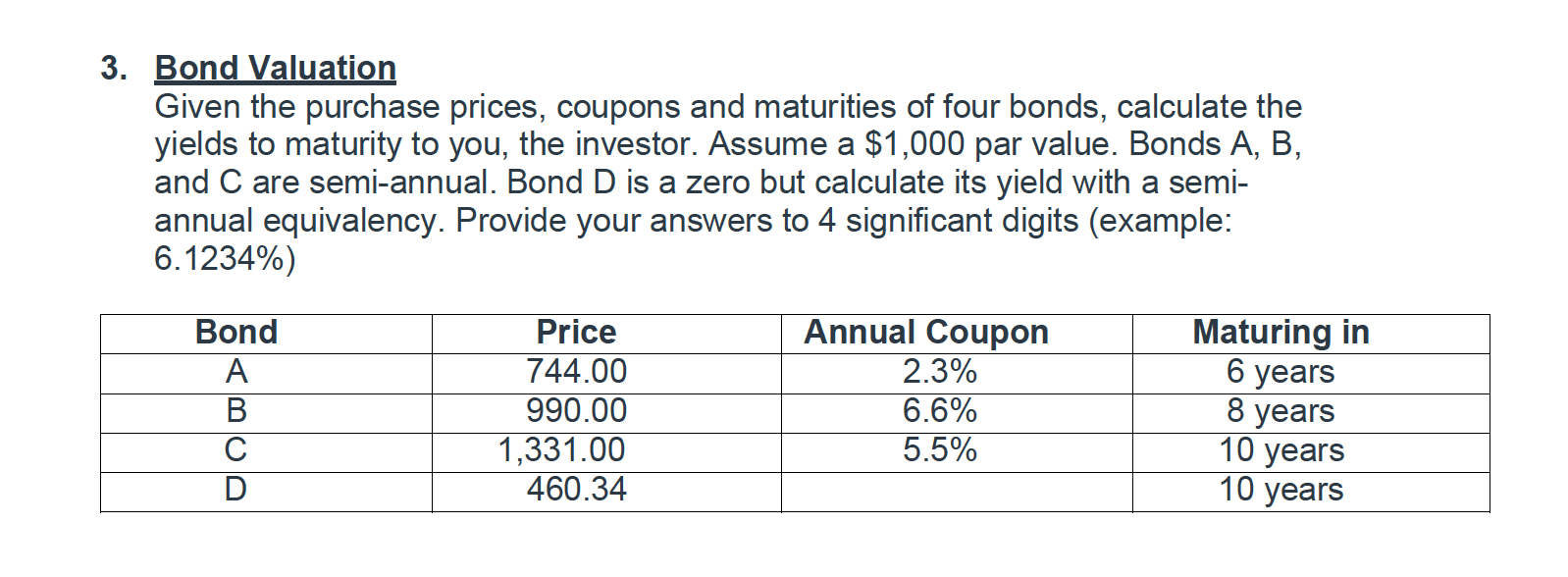

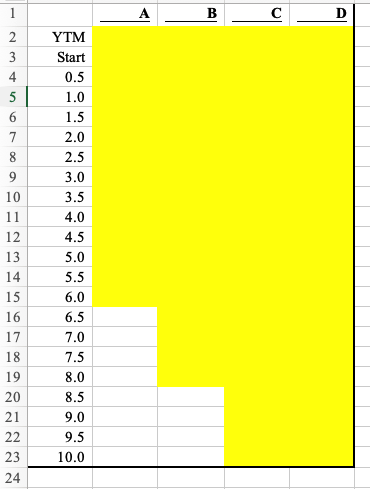

3. Bond Valuation Given the purchase prices, coupons and maturities of four bonds, calculate the yields to maturity to you, the investor. Assume a $1,000 par value. Bonds A, B, and C are semi-annual. Bond D is a zero but calculate its yield with a semi- annual equivalency. Provide your answers to 4 significant digits (example: 6.1234%) Bond A B D Price 744.00 990.00 1,331.00 460.34 Annual Coupon 2.3% 6.6% 5.5% Maturing in 6 years 8 years 10 years 10 years B D YTM Start 2 3 4 5 0.5 1.0 1.5 2.0 2.5 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts