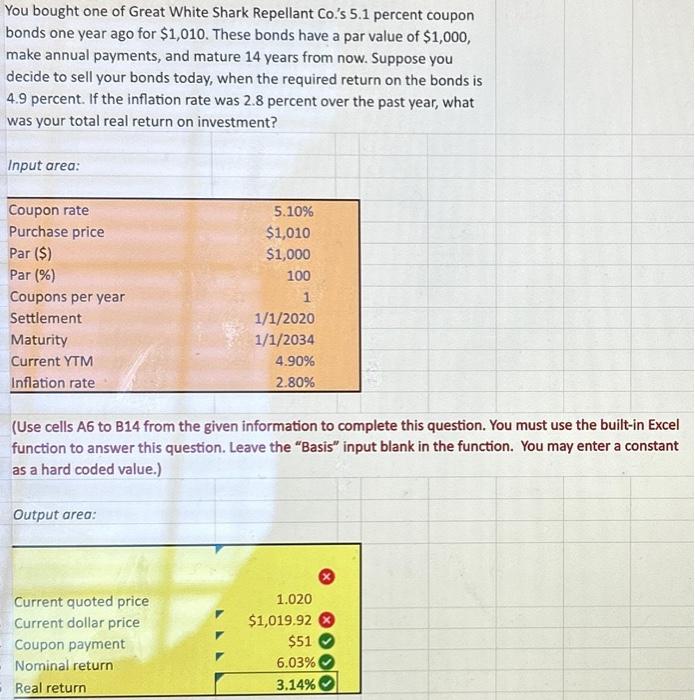

Question: PLEASE SHOW EXCEL FORMULA FOR CURRENT QUOTED PRICE AND CURRENT DOLLAR PRICE You bought one of Great White Shark Repellant Co.'s 5.1 percent coupon bonds

You bought one of Great White Shark Repellant Co.'s 5.1 percent coupon bonds one year ago for $1,010. These bonds have a par value of $1,000, make annual payments, and mature 14 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 4.9 percent. If the inflation rate was 2.8 percent over the past year, what was your total real return on investment? (Use cells A6 to B14 from the given information to complete this question. You must use the built-in Excel function to answer this question. Leave the "Basis" input blank in the function. You may enter a constant as a hard coded value.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts