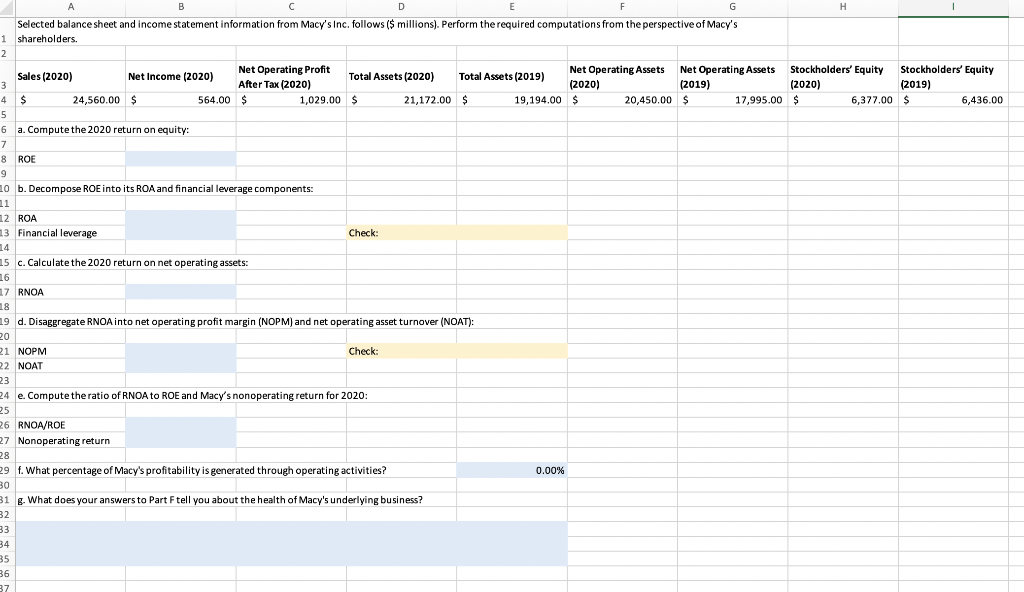

Question: PLEASE SHOW EXCEL FORMULAS A H B D E F G Selected balance sheet and income statement information from Macy's Inc. follows ($ millions). Perform

PLEASE SHOW EXCEL FORMULAS

A H B D E F G Selected balance sheet and income statement information from Macy's Inc. follows ($ millions). Perform the required computations from the perspective of Macy's 1 shareholders. 2 Net Operating Profit Net Income (2020) Net Operating Assets Total Assets (2020) Net Operating Assets Stockholders' Equity Sales (2020) Stockholders' Equity Total Assets (2019) 3 After Tax (2020) (2020) (2019) (2020) (2019) 4 $ 24,560.00 $ 564.00 $ 1,029.00 $ 21,172.00 S 19,194.00 $ 20,450.00 $ 17,995.00 $ 6,377.00 $ 6,436.00 5 6 a. Compute the 2020 return on equity: 7 8 ROE 9 10 b. Decompose ROE into its ROA and financial leverage components: 11 12 ROA 13 Financial leverage Check: 14 15 c. Calculate the 2020 return on net operating assets: 16 17 RNOA 18 19 d. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT): 20 21 NOPM Check: 22 NOAT 23 24 e. Compute the ratio of RNOA to ROE and Macy's nonoperating return for 2020: 25 26 RNOA/ROE 27 Nonoperating return 28 29 f. What percentage of Macy's profitability is generated through operating activities? 0.00% 30 31 g. What does your answers to Part Ftell you about the health of Macy's underlying business? 32 33 34 35 36 37 A H B D E F G Selected balance sheet and income statement information from Macy's Inc. follows ($ millions). Perform the required computations from the perspective of Macy's 1 shareholders. 2 Net Operating Profit Net Income (2020) Net Operating Assets Total Assets (2020) Net Operating Assets Stockholders' Equity Sales (2020) Stockholders' Equity Total Assets (2019) 3 After Tax (2020) (2020) (2019) (2020) (2019) 4 $ 24,560.00 $ 564.00 $ 1,029.00 $ 21,172.00 S 19,194.00 $ 20,450.00 $ 17,995.00 $ 6,377.00 $ 6,436.00 5 6 a. Compute the 2020 return on equity: 7 8 ROE 9 10 b. Decompose ROE into its ROA and financial leverage components: 11 12 ROA 13 Financial leverage Check: 14 15 c. Calculate the 2020 return on net operating assets: 16 17 RNOA 18 19 d. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT): 20 21 NOPM Check: 22 NOAT 23 24 e. Compute the ratio of RNOA to ROE and Macy's nonoperating return for 2020: 25 26 RNOA/ROE 27 Nonoperating return 28 29 f. What percentage of Macy's profitability is generated through operating activities? 0.00% 30 31 g. What does your answers to Part Ftell you about the health of Macy's underlying business? 32 33 34 35 36 37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts