Question: *** PLEASE SHOW EXCEL FORMULAS AND FINAL RESULTS. THANKS *** Note: Each of this question involve the creation of a new set of expected results

*** PLEASE SHOW EXCEL FORMULAS AND FINAL RESULTS. THANKS ***

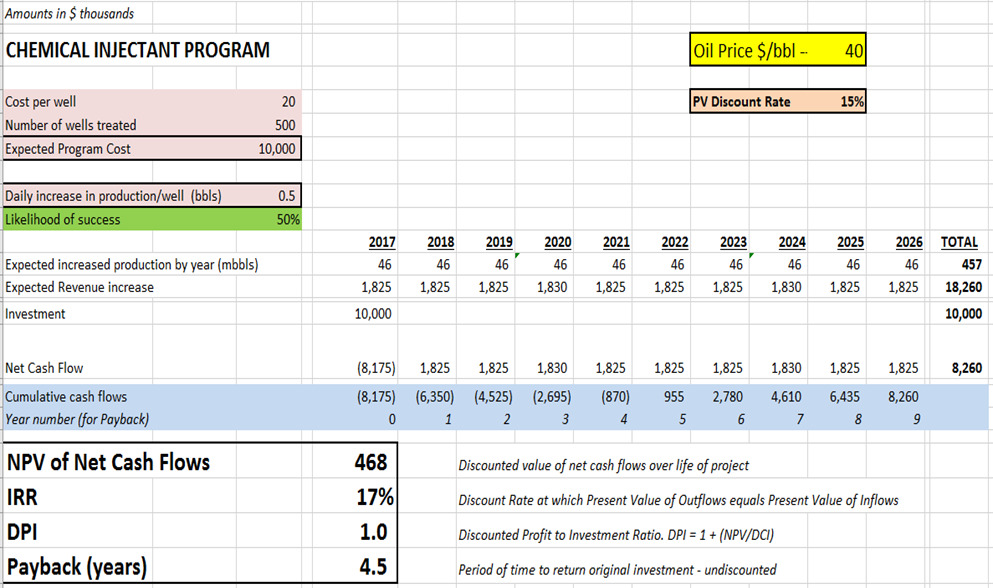

Note: Each of this question involve the creation of a new set of expected results NPV, IRR, DPI and Payout. Use of the original model is recommended, but be sure to return to the base assumptions before starting on the next question. -- PLEASE SHOW EXCEL FORMULAS AND FINAL RESULTS. THANKS

QUESTION 1.

The Management Team is presented with an interesting alternative from the Chief Production Engineer. The Chief Production Engineer reports that she can make a less expensive blend of chemicals for well treatment. The proposed blend will reduce cost per well by $2, however, the project will incur a maintenance cost from Year 1 (year after investment) to Year 5 of 1% of the initial investment, and it will increase to 2% from Year 6 onwards.

Re-run the model using this alternative. Would you recommend this proposal? Make sure to quantify your answer by comparing your results to the original (NPV, IRR, etc)

QUESTION 2.

Assume Gallimbo has another option to invest only $7.2 million dollars upfront; however, with this option they can only treat 80% of the number of wells.

a) Recalculate the project metrics and compare it to the original case.

b) Should Gallimbo pick this alternative with less investment? Why or why not?

QUESTION 3.

Gallimbo has been introduced to a new injection management system that can provide better diagnostics, reduce over-injection, and improve crude quality.. This new injection management system requires a one-time initial investment of $10 million. The expected result is a reduction in cost per well of 20%, a daily increase in production of 0.75 bbls (compared to 0.5 in the original case), and an increase in likelihood of success to 75% (compared to 50% in the original case).

a) Recalculate the metrics and compare the results to the original case.

b) Should Gallimbo pick this alternative? Why or why not?

*** PLEASE SHOW EXCEL FORMULAS AND FINAL RESULTS. THANKS ***

Amounts in $ thousands CHEMICAL INJECTANT PROGRAM Oil Price $/bbl PV Discount Rate 15% Cost per wel Number of wells treated Expected Program Cost 20 500 10,000 0.5 Daily increase in production/well (bbls) Likelihood of success 2017 2182019 2020 2021 20222023 2024 2025 2026 TOTAL Expected increased production by year (mbbls) Expected Revenue increase Investment 457 1,825 1,825 1,825 1,830 1,825 1,825 1,825 1,830 1,825 1,825 18,260 10,000 46 46 46 46 46 46 46 46 10,000 Net Cash Flow Cumulative cash flows Year number (for Payback) (8,175 1,825 1,825 1,830 1,825 1,825 1,825 1,830 1,825 1,825 8,260 (8,175) (6,350) (4,525) 2,695) (870) 955 2,780 4,610 6,435 8,260 NPV of Net Cash Flows IRR DPI Payback (years) 468 17% 1.0 4.5 Discounted value of net cash flows over life of project Discount Rate at which Present Value of Outflows equals Present Value of Inflows Discounted Profit to Investment Ratio. DPl 1(NPV/DCI) Period of time to return original investment undiscounted Amounts in $ thousands CHEMICAL INJECTANT PROGRAM Oil Price $/bbl PV Discount Rate 15% Cost per wel Number of wells treated Expected Program Cost 20 500 10,000 0.5 Daily increase in production/well (bbls) Likelihood of success 2017 2182019 2020 2021 20222023 2024 2025 2026 TOTAL Expected increased production by year (mbbls) Expected Revenue increase Investment 457 1,825 1,825 1,825 1,830 1,825 1,825 1,825 1,830 1,825 1,825 18,260 10,000 46 46 46 46 46 46 46 46 10,000 Net Cash Flow Cumulative cash flows Year number (for Payback) (8,175 1,825 1,825 1,830 1,825 1,825 1,825 1,830 1,825 1,825 8,260 (8,175) (6,350) (4,525) 2,695) (870) 955 2,780 4,610 6,435 8,260 NPV of Net Cash Flows IRR DPI Payback (years) 468 17% 1.0 4.5 Discounted value of net cash flows over life of project Discount Rate at which Present Value of Outflows equals Present Value of Inflows Discounted Profit to Investment Ratio. DPl 1(NPV/DCI) Period of time to return original investment undiscounted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts