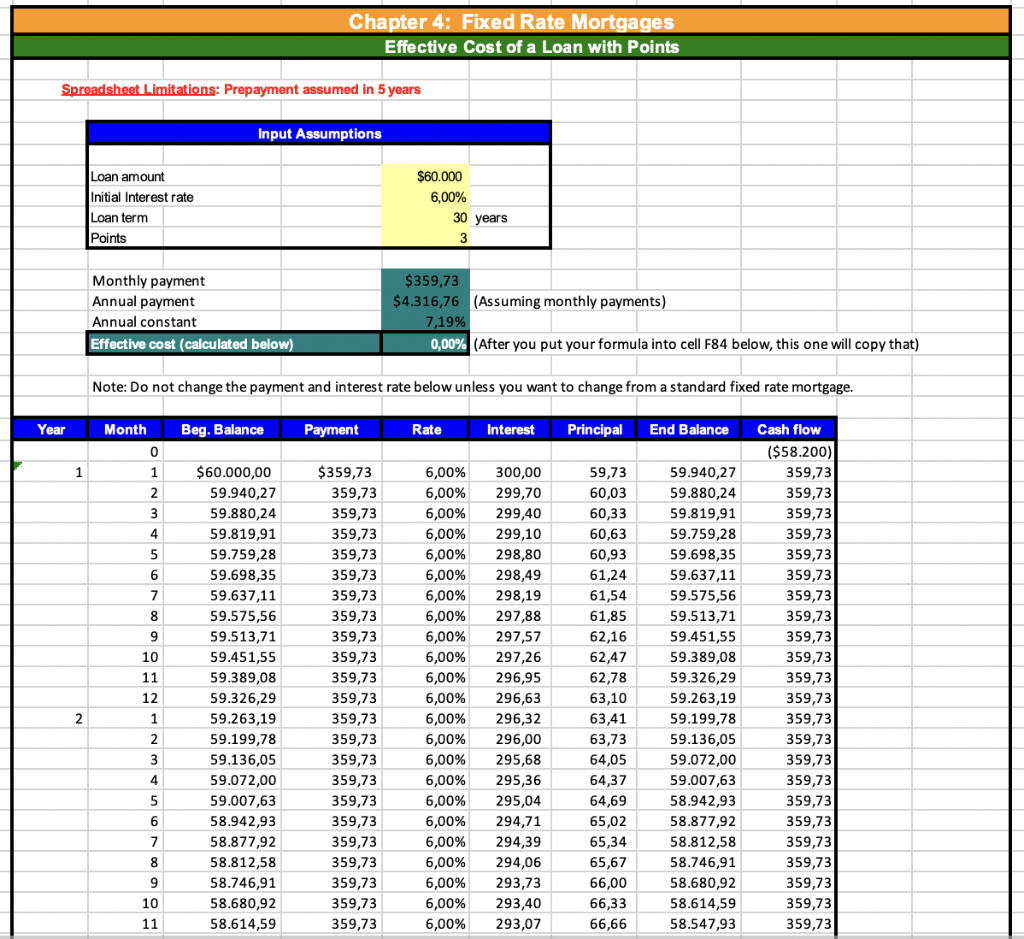

Question: Please show excel formulas Chapter 4: Fixed Rate Mortgages Effective Cost of a Loan with Points Spreadsheet Limitations: Prepayment assumed in 5 years Input Assumptions

Please show excel formulas

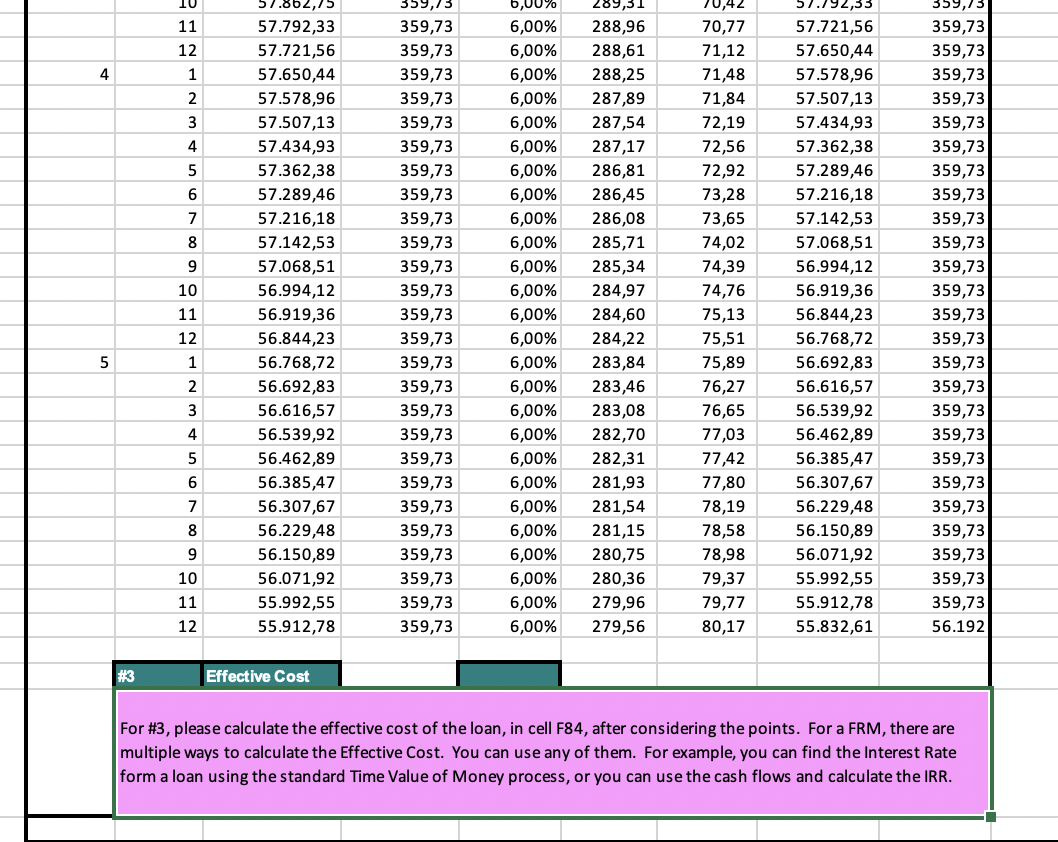

Chapter 4: Fixed Rate Mortgages Effective Cost of a Loan with Points Spreadsheet Limitations: Prepayment assumed in 5 years Input Assumptions Loan amount Initial Interest rate Loan term Points $60.000 6,00% 30 years 3 Monthly payment Annual payment Annual constant Effective cost (calculated below) $359,73 $4.316,76 (Assuming monthly payments) 7,19% 0,00% (After you put your formula into cell F84 below, this one will copy that) Note: Do not change the payment and interest rate below unless you want to change from a standard fixed rate mortgage. Year Month Beg. Balance Payment Rate Interest Principal End Balance 0 1 1 2 3 4 5 6 7 8 9 10 11 $60.000,00 59.940,27 59.880,24 59.819,91 59.759,28 59.698,35 59.637,11 59.575,56 59.513,71 59.451,55 59.389,08 59.326,29 59.263,19 59.199,78 59.136,05 59.072,00 59.007,63 58.942,93 58.877,92 58.812,58 58.746,91 58.680,92 58.614,59 12. $359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 300,00 299,70 299,40 299,10 298,80 298,49 298,19 297,88 297,57 297,26 296,95 296,63 296,32 296,00 295,68 295,36 295,04 294,71 294,39 294,06 293,73 293,40 293,07 59,73 60,03 60,33 60,63 60,93 61,24 61,54 61,85 62,16 62,47 62,78 63,10 63,41 63,73 64,05 64,37 64,69 65,02 65,34 65,67 66,00 66,33 66,66 Cash flow ($58.200) 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 59.940,27 59.880,24 59.819,91 59.759,28 59.698,35 59.637,11 59.575,56 59.513,71 59.451,55 59.389,08 59.326,29 59.263,19 59.199,78 59.136,05 59.072,00 59.007,63 58.942,93 58.877,92 58.812,58 58.746,91 58.680,92 58.614,59 58.547,93 2 1 2 3 4 5 6 7 8 9 10 11 11 12 1 4 2 3 4 5 6 7 8 9 10 11 07.862,15 57.792,33 57.721,56 57.650,44 57.578,96 57.507,13 57.434,93 57.362,38 57.289,46 57.216,18 57.142,53 57.068,51 56.994,12 56.919,36 56.844,23 56.768,72 56.692,83 56.616,57 56.539,92 56.462,89 56.385,47 56.307,67 56.229,48 56.150,89 56.071,92 55.992,55 55.912,78 359,13 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 6,00% 289,31 288,96 288,61 288,25 287,89 287,54 287,17 286,81 286,45 286,08 285,71 285,34 284,97 284,60 284,22 283,84 283,46 283,08 282,70 282,31 281,93 281,54 281,15 280,75 280,36 279,96 279,56 70,42 70,77 71,12 71,48 71,84 72,19 72,56 72,92 73,28 73,65 74,02 74,39 74,76 75,13 75,51 75,89 76,27 76,65 77,03 77,42 77,80 78,19 78,58 78,98 79,37 79,77 80,17 57.792,35 57.721,56 57.650,44 57.578,96 57.507,13 57.434,93 57.362,38 57.289,46 57.216,18 57.142,53 57.068,51 56.994,12 56.919,36 56.844,23 56.768,72 56.692,83 56.616,57 56.539,92 56.462,89 56.385,47 56.307,67 56.229,48 56.150,89 56.071,92 55.992,55 55.912,78 55.832,61 359,13 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 359,73 56.192 12 5 1 2 3 4 +00 5 6 7 9 10 11 12 #3 Effective Cost For #3, please calculate the effective cost of the loan, in cell F84, after considering the points. For a FRM, there are multiple ways to calculate the Effective Cost. You can use any of them. For example, you can find the Interest Rate form a loan using the standard Time Value of Money process, or you can use the cash flows and calculate the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts