Question: Please show EXCEL FORMULAS for how you derive answers please, THANK YOU! Case Study 3--Capital Budgeting (Comprehensive Spreadsheet Problem 11-23 from the end-of-chapter question set)

Please show EXCEL FORMULAS for how you derive answers please, THANK YOU!

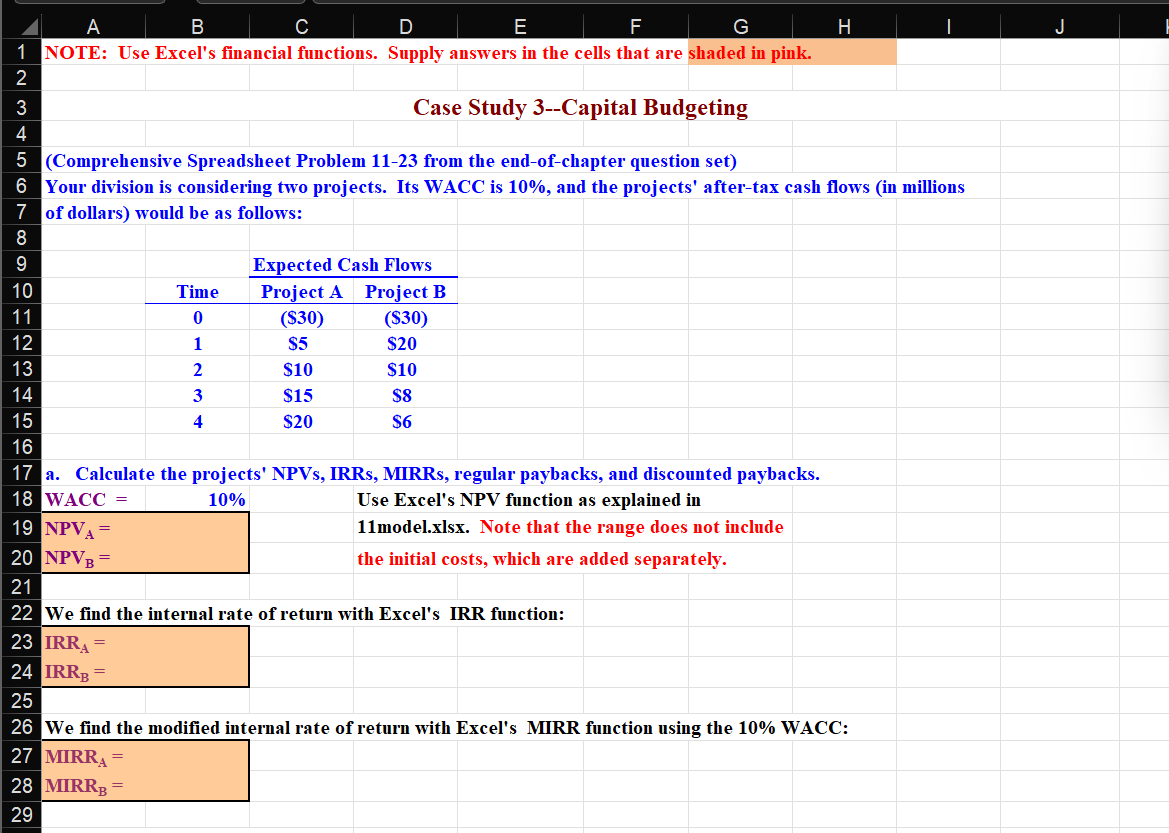

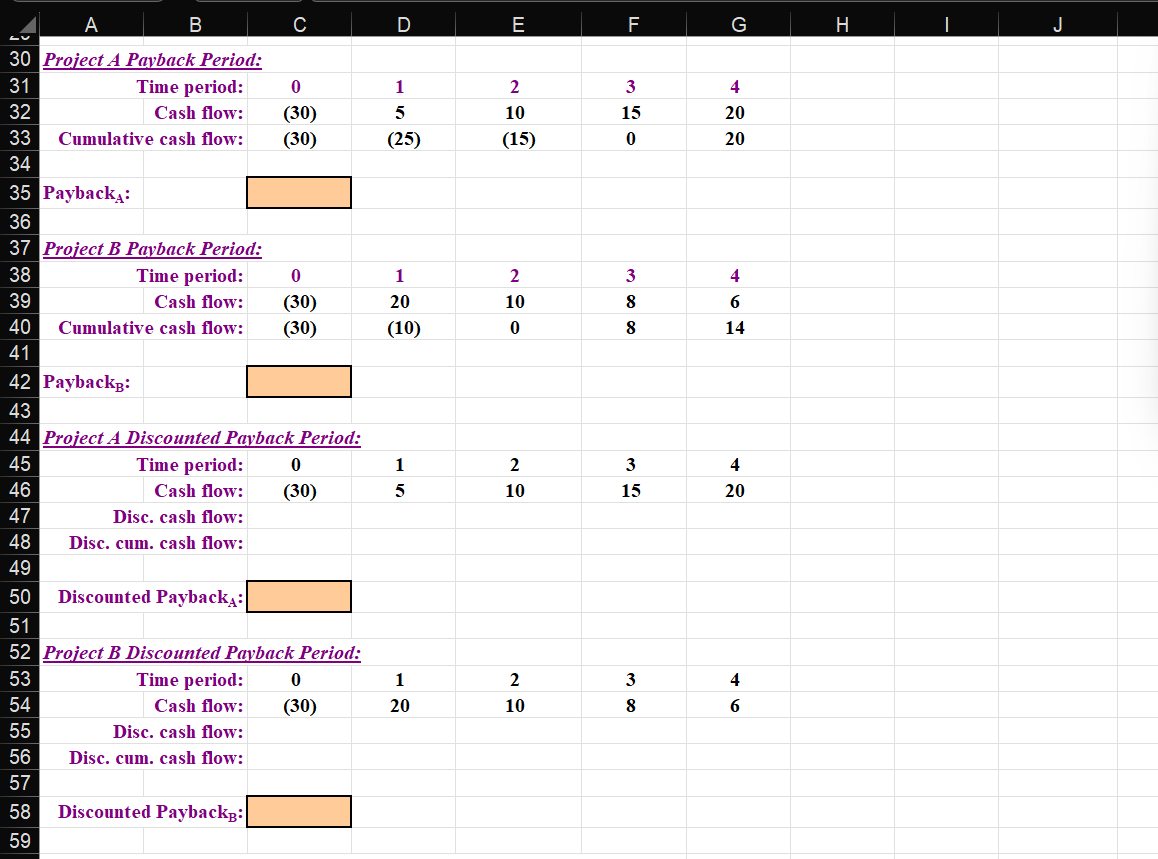

Case Study 3--Capital Budgeting (Comprehensive Spreadsheet Problem 11-23 from the end-of-chapter question set) Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: a. Calculate the projects' NPVs, IRRs, MIRRs, regular paybacks, and discounted paybacks. We find the internal rate of return with Excel's IRR function: IRRA=IRRB= We find the modified internal rate of return with Excel's MIRR function using the 10\% WACC: MIRRA= MIRRB= Case Study 3--Capital Budgeting (Comprehensive Spreadsheet Problem 11-23 from the end-of-chapter question set) Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: a. Calculate the projects' NPVs, IRRs, MIRRs, regular paybacks, and discounted paybacks. We find the internal rate of return with Excel's IRR function: IRRA=IRRB= We find the modified internal rate of return with Excel's MIRR function using the 10\% WACC: MIRRA= MIRRB=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts