Question: Please show excel formulas. Problem 8-11 FastTrack Bikes, Inc., is thinking of developing a new composite road bike. Development will take six years and the

Please show excel formulas.

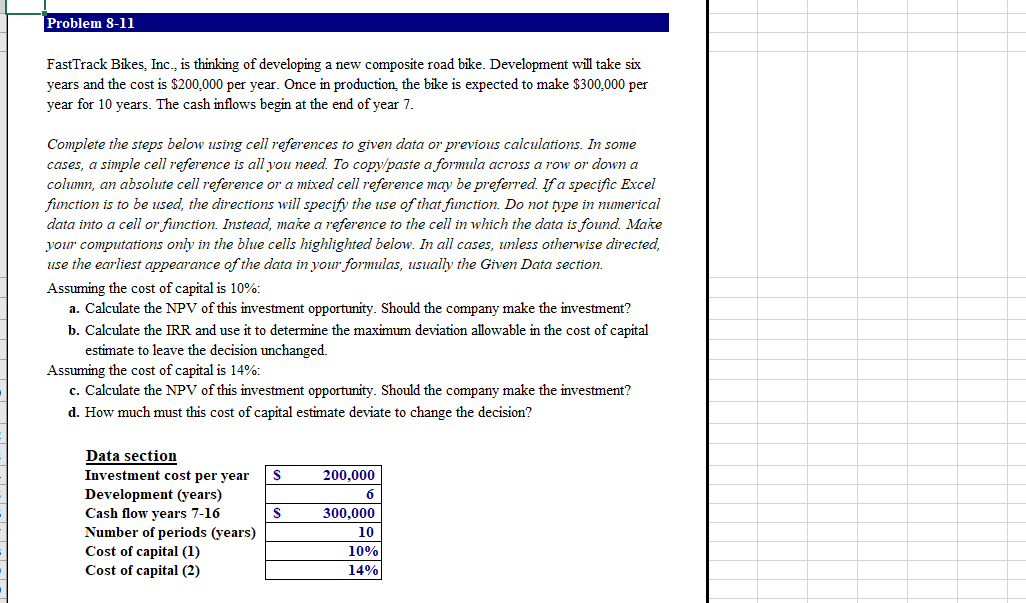

Problem 8-11 FastTrack Bikes, Inc., is thinking of developing a new composite road bike. Development will take six years and the cost is $200,000 per year. Once in production, the bike is expected to make $300,000 per year for 10 years. The cash inflows begin at the end of year 7. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Assuming the cost of capital is 10%: a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. Assuming the cost of capital is 14%: c. Calculate the NPV of this investment opportunity. Should the company make the investment? d. How much must this cost of capital estimate deviate to change the decision? S Data section Investment cost per year Development (years) Cash flow years 7-16 Number of periods (years) Cost of capital (1) Cost of capital (2) S 200,000 6 300,000 10 10% 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts