Question: please show excel work and steps. thanks ABC had EPS of $3.15 last year and expects EPS to increase by 20% next year. Earnings per

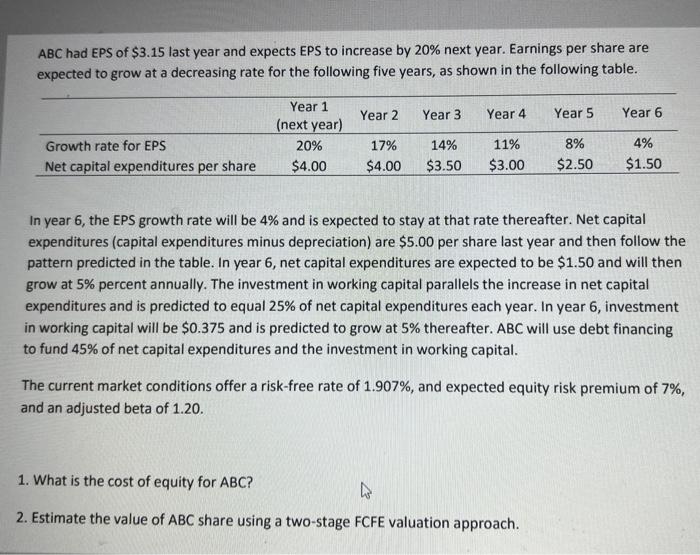

ABC had EPS of $3.15 last year and expects EPS to increase by 20% next year. Earnings per share are expected to grow at a decreasing rate for the following five years, as shown in the following table. In year 6, the EPS growth rate will be 4% and is expected to stay at that rate thereafter. Net capital expenditures (capital expenditures minus depreciation) are $5.00 per share last year and then follow the pattern predicted in the table. In year 6 , net capital expenditures are expected to be $1.50 and will then grow at 5% percent annually. The investment in working capital parallels the increase in net capital expenditures and is predicted to equal 25% of net capital expenditures each year. In year 6 , investment in working capital will be $0.375 and is predicted to grow at 5% thereafter. ABC will use debt financing to fund 45% of net capital expenditures and the investment in working capital. The current market conditions offer a risk-free rate of 1.907%, and expected equity risk premium of 7%, and an adjusted beta of 1.20. 1. What is the cost of equity for ABC ? 2. Estimate the value of ABC share using a two-stage FCFE valuation approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts