Question: please show excel workings in cell reference Suppose Acap Corporation will pay a dividend of $2.80 per share at the end of this year and

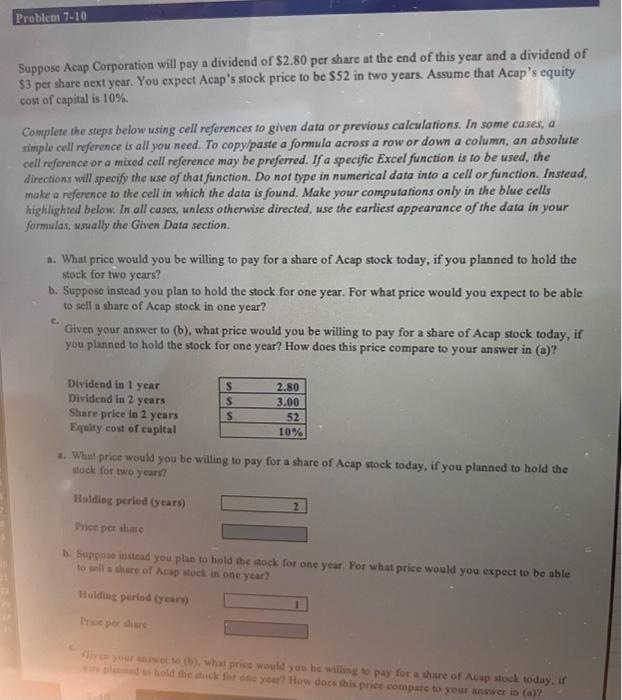

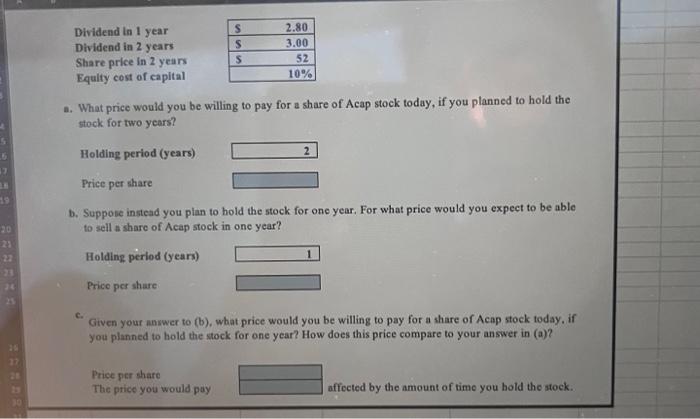

Suppose Acap Corporation will pay a dividend of $2.80 per share at the end of this year and a dividend of $3 per share next year. You expect Acap's stock price to be $52 in two years. Assume that Acap's equity cost of capital is 10%. Complete the steps below using cell neferences to given data or previous calculations. In some cases, a simple cell neference ir all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless othenvise directed, use the earliest appearance of the data in your formulas, uswally the Given Data section. a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the sock for two years? b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? C. Given your answer to (b), what price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for one year? How does this price compare to your answer in (a)? a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the itock for two ycars? 6. Suppose inacad you plan to hold the atock for one year. For what price would you expect to be able to iall a thure of Aemp atock in nase year? Holding perisd (year) Prise per alare a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? c. Given your answer to (b), what price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for one year? How does this price compare to your answer in (a)? Priee per share The price you would pay affected by the amount of time you hold the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts