Question: Please show formula and all work please You plan to start saving for your retirement by depositing $10:000 exactly one year from now. Each year

Please show formula and all work please

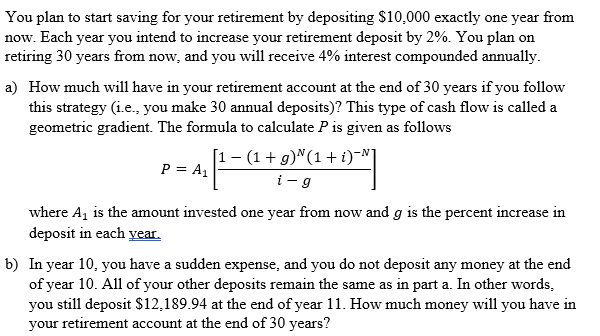

You plan to start saving for your retirement by depositing $10:000 exactly one year from now. Each year you intend to increase your retirement deposit by 2%. You plan on retiring 30 years from now, and you will receive 4% interest compounded annually. a) How much will have in your retirement account at the end of 30 years if you follow this strategy (i.e., you make 30 annual deposits)? This type of cash flow is called a geometric gradient. The formula to calculate P is given as follows P = A_1 [1 - (1 + g)^N (1 + i)^-N/i - g] where A_1 is the amount invested one year from now and g is the percent increase in deposit in each year. b) In year 10, you have a sudden expense, and you do not deposit any money at the end of year 10. All of your other deposits remain the same as in part a. In other words, you still deposit $12, 189.94 at the end of year 11. How much money will you have in your retirement account at the end of 30 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts