Question: Please show formula and explain how you got answer. Thanks! The comparative income statements of. Company follow. Calculate trend percents for all components of the

Please show formula and explain how you got answer.

Thanks!

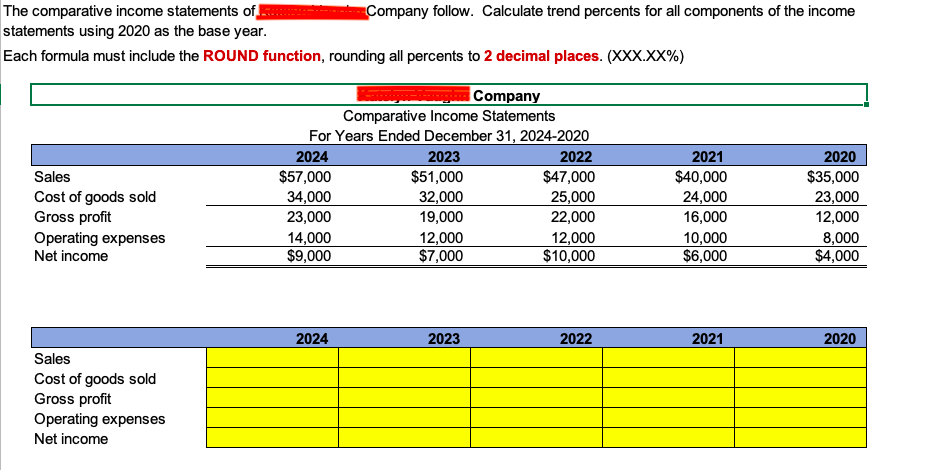

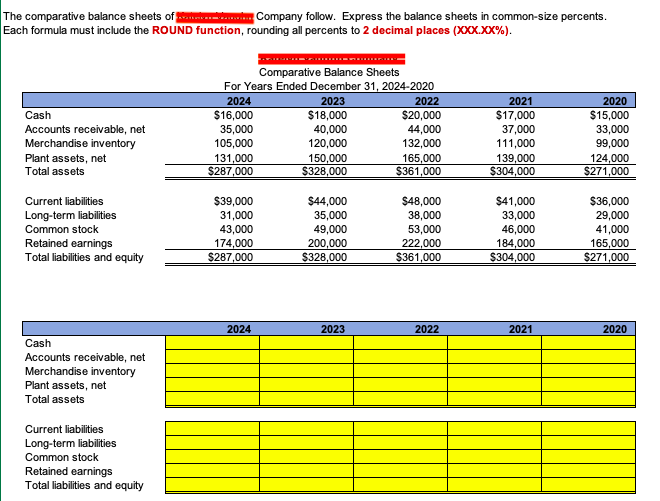

The comparative income statements of. Company follow. Calculate trend percents for all components of the income statements using 2020 as the base year. Each formula must include the ROUND function, rounding all percents to 2 decimal places. (XXX.XX%) Sales Cost of goods sold Gross profit Operating expenses Net income Company Comparative Income Statements For Years Ended December 31, 2024-2020 2024 2023 2022 $57,000 $51,000 $47,000 34,000 32,000 25,000 23,000 19,000 22,000 14,000 12,000 12,000 $9,000 $7,000 $10,000 2021 $40,000 24,000 16,000 10,000 $6,000 2020 $35,000 23,000 12,000 8,000 $4,000 2024 2023 2022 2021 2020 Sales Cost of goods sold Gross profit Operating expenses Net income The comparative balance sheets of Company follow. Express the balance sheets in common-size percents. Each formula must include the ROUND function, rounding all percents to 2 decimal places (XXX.XX%). Cash Accounts receivable, net Merchandise inventory Plant assets, net Total assets Comparative Balance Sheets For Years Ended December 31, 2024-2020 2024 2023 2022 $16,000 $18,000 $20,000 35,000 40,000 44,000 105,000 120,000 132,000 131,000 150,000 165,000 $287,000 $328,000 $361,000 2021 $17,000 37,000 111,000 139,000 $304,000 2020 $15,000 33,000 99,000 124,000 $271.000 Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and equity $39,000 31,000 43,000 174,000 $287,000 $44,000 35,000 49,000 200,000 $328,000 $48,000 38,000 53,000 222,000 $361,000 $41,000 33,000 46,000 184,000 $304,000 $36,000 29,000 41,000 165,000 $271,000 2024 2023 2022 2021 2020 Cash Accounts receivable, net Merchandise inventory Plant assets, net Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts