Question: please show formula and step by step solution. thanks 12. A French firm has 500 million worth of debt denominated in Euros. The yield to

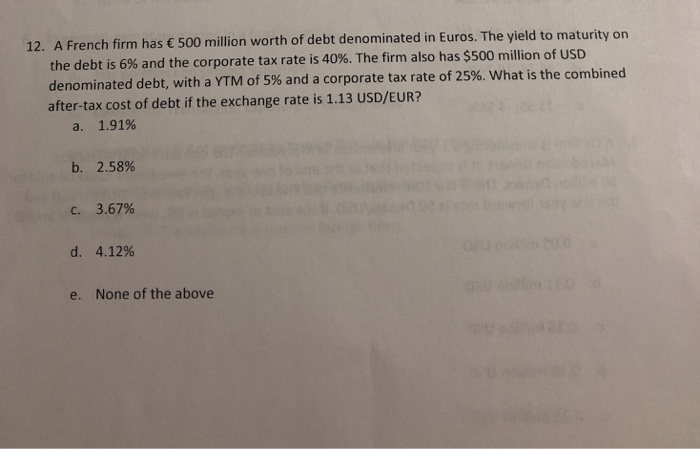

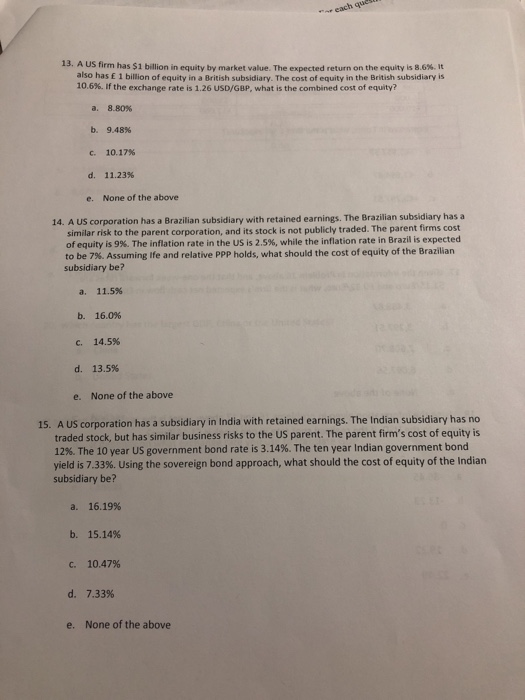

12. A French firm has 500 million worth of debt denominated in Euros. The yield to maturity on the debt is 6% and the corporate tax rate is 40%. The firm also has $500 million of USD denominated debt, with a YTM of 5% and a corporate tax rate of 25%, what is the combined after-tax cost of debt if the exchange rate is 1.13 USD/EUR? 1.91% a. b. 2.58% . 3.67% d. 4.12% e. None of the above 13. A US firm has $1 billion in equity by market value. The also has E 1 billion of equity in a British subsidiary. The cost of equity in the British subsidiary is 10.6%. If the exchange rate is 1.26 USD/GBP, what is the combined cost of equity? 8.80% a. b. 9.48% 10.17% 11.23% None of the above c. d. e. 14. A US corporation has a Brazilian subsidiary with retained earnings. The Brazilian subsidiary has a similar risk to the parent corporation, and its stock is not publicly traded. The parent firms cost of equity is 9%. The inflation rate in the US is 2.5%, while the inflation rate in Brazil is expected to be 7% Assuming ife and relative PPP holds, what should the cost of equity of the Brazilian subsidiary be? a. 11.5% b. 16.0% . 14.5% d. 13.5% e. None of the above 15. A US corporation has a subsidiary in India with retained earnings. The Indian subsidiary has no traded stock, but has similar business risks to the US parent. The parent firm's cost of equity is 12%. The 10 year US government bond rate is 3.14%. The ten year Indian government bond yield is 7.33%, using the sovereign bond approach, what should the cost of equity of the Indian subsidiary be? a. 16.19% b. 15.14% c. 10.47% d. 7.33% e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts