Question: please show formula and work please thanks A construction company purchases an excavator for $ 300,000. This is classified in the 5-year property class using

please show formula and work please

thanks

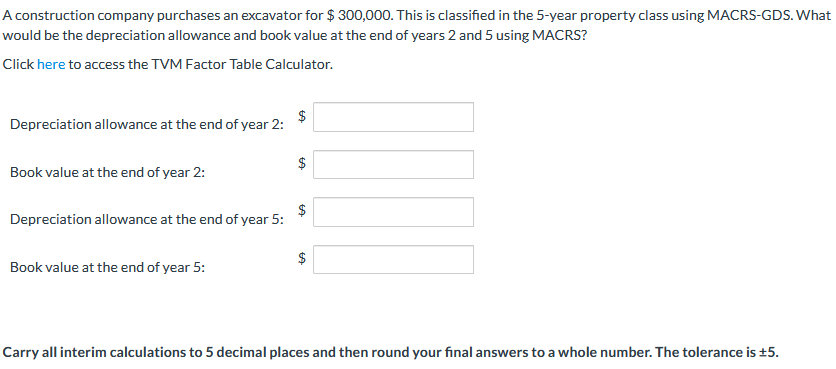

A construction company purchases an excavator for $ 300,000. This is classified in the 5-year property class using MACRS-GDS. What would be the depreciation allowance and book value at the end of years 2 and 5 using MACRS? Click here to access the TVM Factor Table Calculator. $ Depreciation allowance at the end of year 2: $ Book value at the end of year 2: $ Depreciation allowance at the end of year 5: GA Book value at the end of year 5: Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +5

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock