Question: please show formula and working Problem 7. (9 marks) Three years ago, you purchased a 30 year, $1,000 par value bond for a quoted price

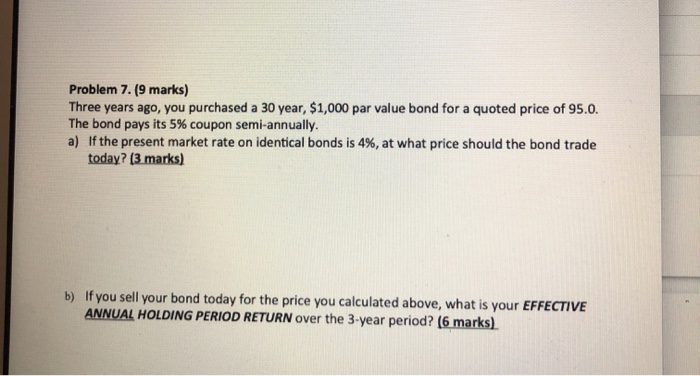

Problem 7. (9 marks) Three years ago, you purchased a 30 year, $1,000 par value bond for a quoted price of 95.0. The bond pays its 5% coupon semi-annually. a) If the present market rate on identical bonds is 4%, at what price should the bond trade today? (3 marks) b) If you sell your bond today for the price you calculated above, what is your EFFECTIVE ANNUAL HOLDING PERIOD RETURN over the 3-year period? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts