Question: - Please show formula used to get answer in excel- Foundation, Inc., is comparing two different capital structures: an all-equity plan (Plan I) and a

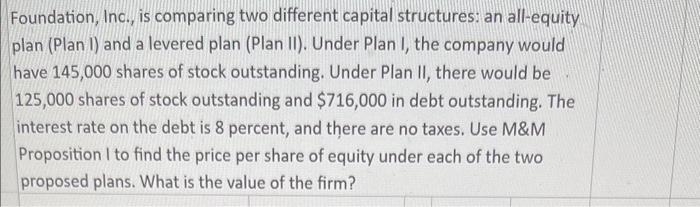

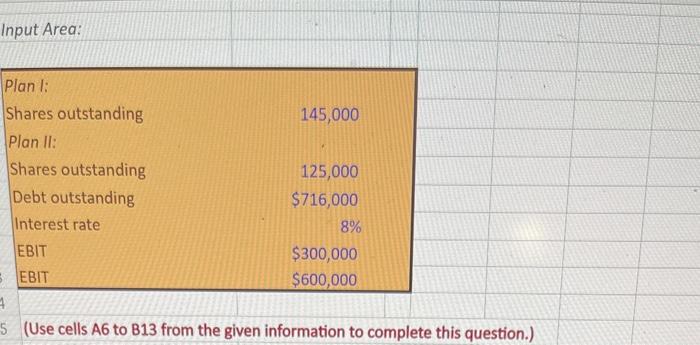

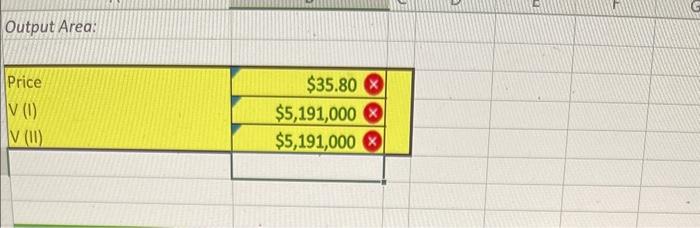

Foundation, Inc., is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 145,000 shares of stock outstanding. Under Plan II, there would be 125,000 shares of stock outstanding and $716,000 in debt outstanding. The interest rate on the debt is 8 percent, and there are no taxes. Use M&M Proposition I to find the price per share of equity under each of the two proposed plans. What is the value of the firm? (Use cells A6 to B13 from the given information to complete this question.) Output Area: \begin{tabular}{|l|r|} \hline Price & $35.80 \\ \hlineV (I) & $5,191,000 \\ \hlineV (II) & $5,191,000 \\ \hline & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts