Question: Please show formulas 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically

Please show formulas

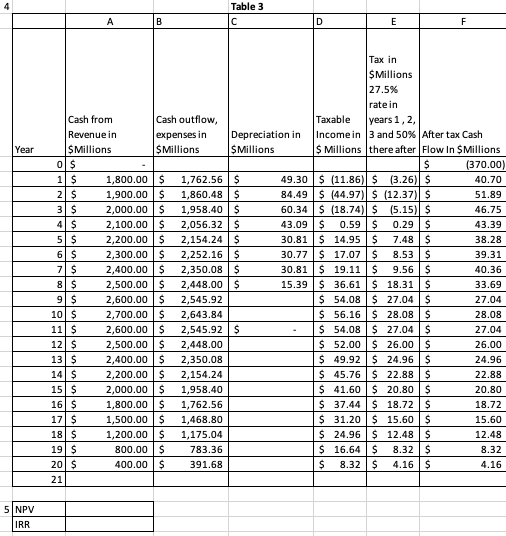

4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below.

5. Calculate the NPV and IRR using the data from Table 3.

Table 3 A B D E F Year Tax in SMillions 27.5% rate in Cash from Cash outflow, Taxable years 1, 2, Revenue in expenses in Depreciation in Income in 3 and 50% After tax Cash SMillions SMillions $ Millions $ Millions there after Flow In Millions 0 $ $ (370.00) 1 $ 1,800.00 $ 1,762.56 $ 49.30 $ (11.86) $ (3.26) $ 40.70 2 $ 1,900.00 $ 1,860.48$ 84.49 $ (44.97) $ (12.37) $ 51.89 3 $ 2,000.00 $ 1,958.40 $ 60.34 $ (18.74) $ (5.15) $ 46.75 4 $ 2,100.00 $ 2,056.32$ 43.09 $ 0.59 $ 0.29 $ 43.39 50 $ 2,200.00 $ 2,154.24 $ 30.81 $ 14.95 $ 7.48$ 38.28 6 $ 2,300.00 $ 2,252.16 $ 30.77 $ 17.07$ 8.53 $ 39.31 7 $ 2,400.00 $ 2,350.08 $ 30.81 $ 19.11 $ 9.56 $ 40.36 8 $ 2,500.00 $ 2,448.00 $ 15.39 $ 36.61 $ 18.31 $ 33.69 9 $ 2,600.00 $ 2,545.92 $ 54.08 $ 27.04 $ 27.04 10$ 2,700.00 $ 2,643.84 $ 56.16 $ 28.08$ 28.08 11 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27.04 12 $ 2,500.00 $ 2,448.00 $ 52.00 $ 26.00 $ 26.00 131 $ 2,400.00 $ 2,350.08 $ 49.92 $ 24.96 $ 24.96 14 $ 2,200.00 $ 2,154.24 $ 45.76 $ 22.88 $ 22.88 15$ 2,000.00 $ 1,958.40 $ 41.60 $ 20.80$ 20.80 16 $ 1,800.00 $ 1,762.56 $ 37.44 $ 18.72$ 18.72 171 $ 1,500.00 $ 1,468.80 $ 31.20 $ 15.60 $ 15.60 181 $ 1,200.00 $ 1,175.04 $ 24.96 $ 12.48$ 12.48 19 $ 800.00 $ 783.36 $ 16.64 $ 8.32 $ 8.32 201$ 400.00 $ 391.68 $ 8.32 $ 4.16 $ 4.16 21 5 NPV IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts