Question: Please show formulas and please use EXCEL E3) The Erley Equipment Company purchased a machine 5 years ago at a cost of $100,000. The machine

Please show formulas and please use EXCEL

Please show formulas and please use EXCEL

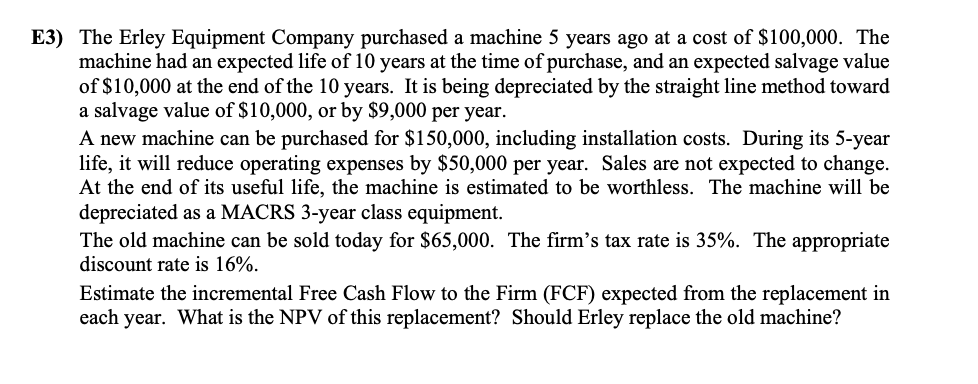

E3) The Erley Equipment Company purchased a machine 5 years ago at a cost of $100,000. The machine had an expected life of 10 years at the time of purchase, and an expected salvage value of $10,000 at the end of the 10 years. It is being depreciated by the straight line method toward a salvage value of $10,000, or by $9,000 per year. A new machine can be purchased for $150,000, including installation costs. During its 5-year life, it will reduce operating expenses by $50,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The machine will be depreciated as a MACRS 3-year class equipment. The old machine can be sold today for $65,000. The firm's tax rate is 35%. The appropriate discount rate is 16%. Estimate the incremental Free Cash Flow to the Firm (FCF) expected from the replacement in each year. What is the NPV of this replacement? Should Erley replace the old machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts