Question: Please show formulas and the full work without the use of excel. years to 2. (13 Points) Price the following bond: A bond that pays

Please show formulas and the full work without the use of excel.

Please show formulas and the full work without the use of excel.

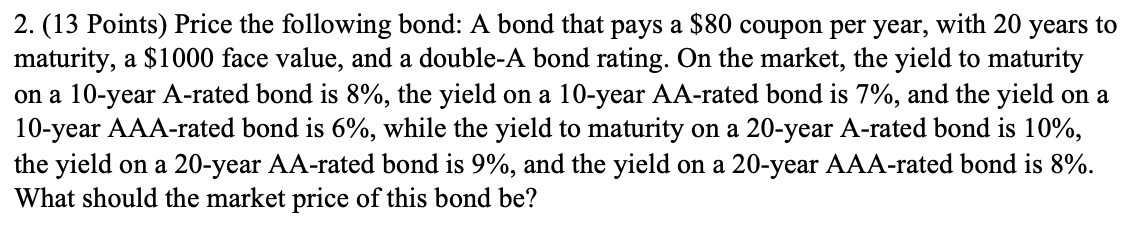

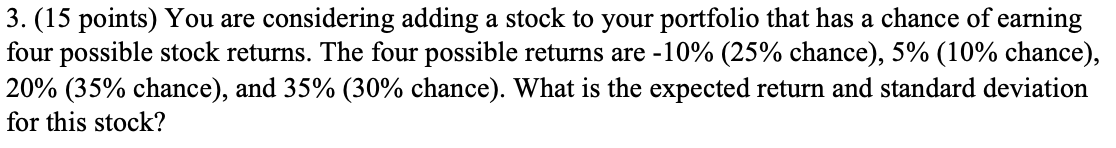

years to 2. (13 Points) Price the following bond: A bond that pays a $80 coupon per year, with 20 maturity, a $1000 face value, and a double-A bond rating. On the market, the yield to maturity on a 10-year A-rated bond is 8%, the yield on a 10-year AA-rated bond is 7%, and the yield on a 10-year AAA-rated bond is 6%, while the yield to maturity on a 20-year A-rated bond is 10%, the yield on a 20-year AA-rated bond is 9%, and the yield on a 20-year AAA-rated bond is 8%. What should the market price of this bond be? 3. (15 points) You are considering adding a stock to your portfolio that has a chance of earning four possible stock returns. The four possible returns are -10% (25% chance), 5% (10% chance), 20% (35% chance), and 35% (30% chance). What is the expected return and standard deviation for this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts