Question: Please show formulas for excel. Question 1: Your neighbor, Jane, approaches you with a proposal. She says, I'm planning to open a coffee shop in

Please show formulas for excel.

Please show formulas for excel.

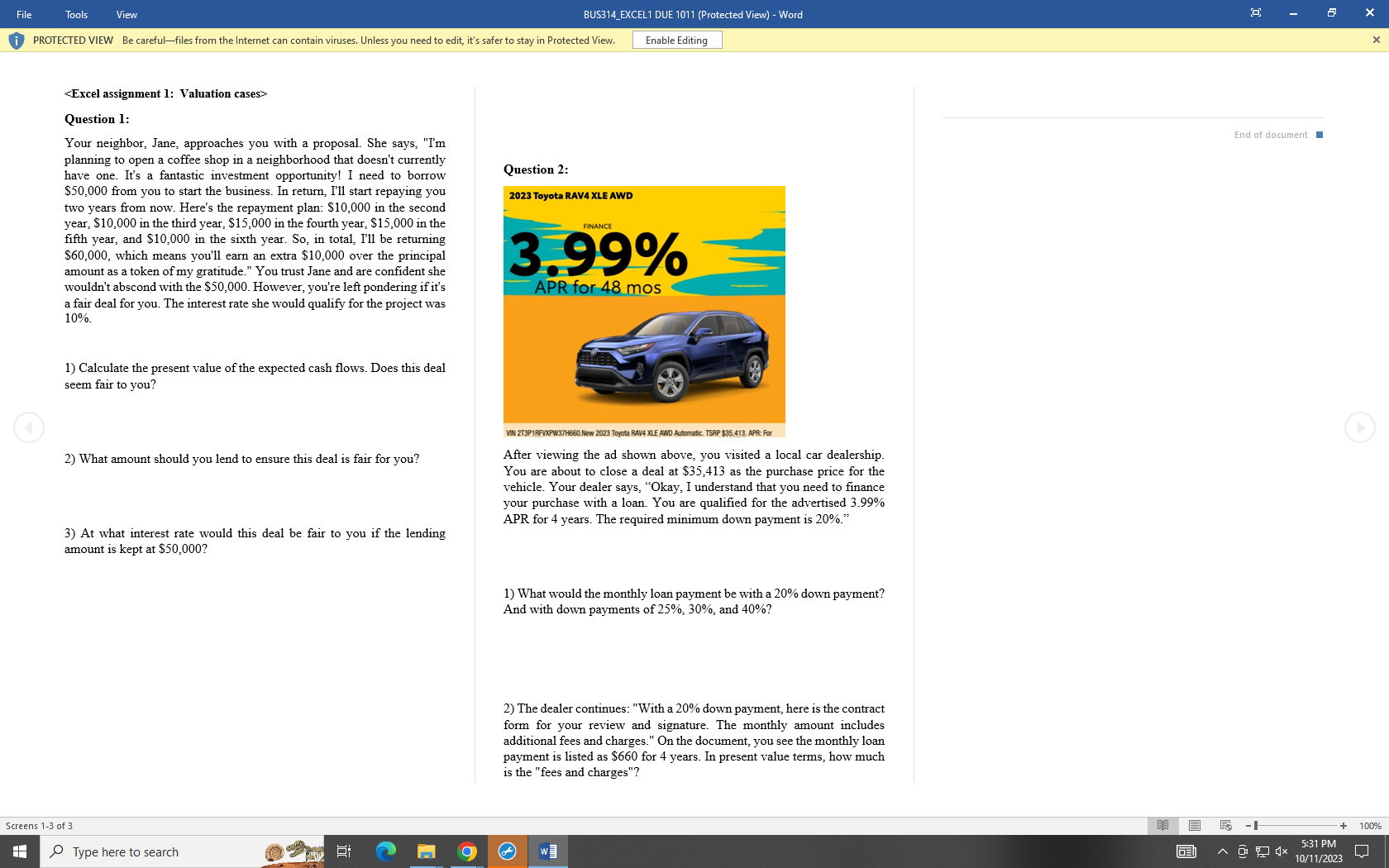

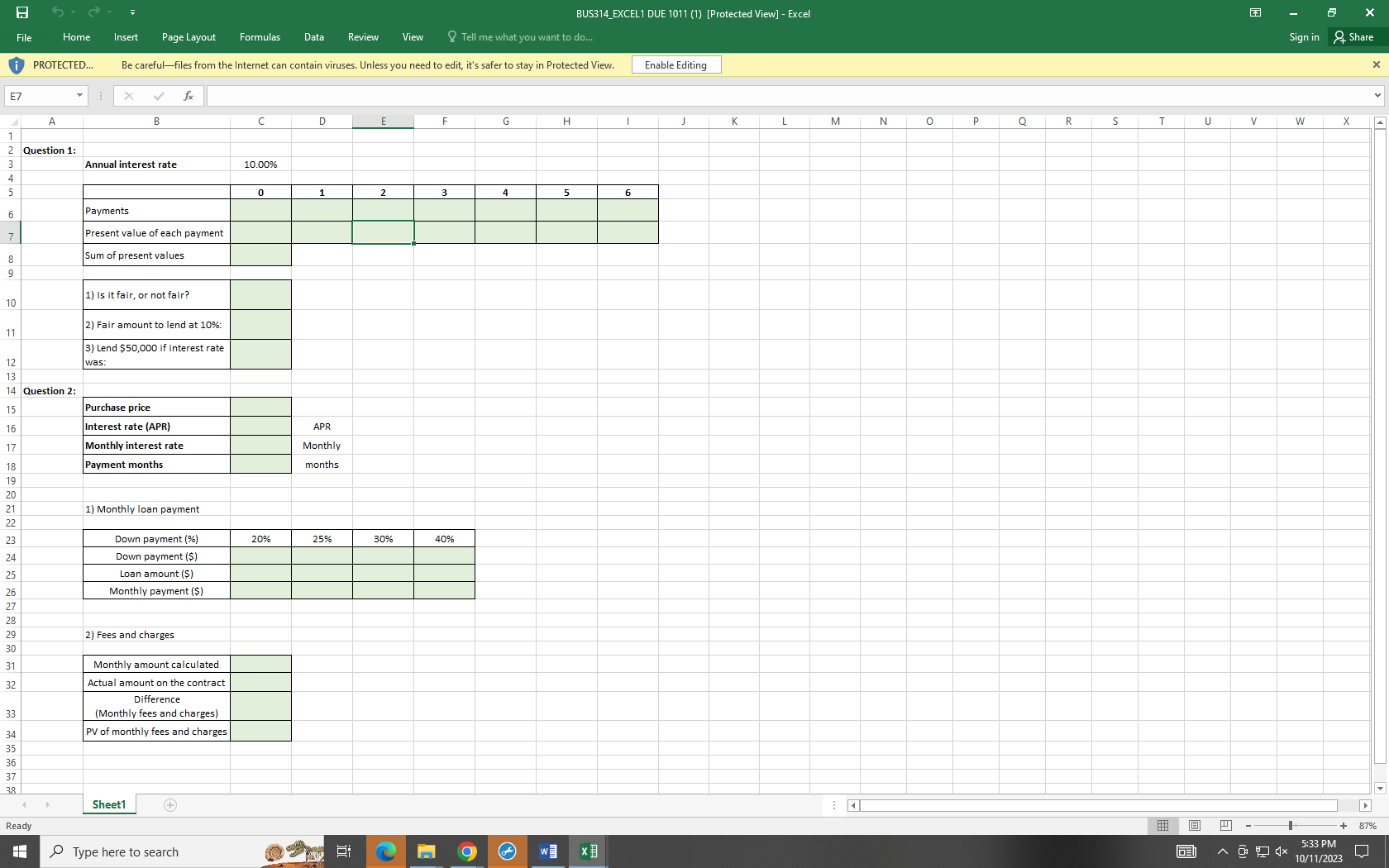

Question 1: Your neighbor, Jane, approaches you with a proposal. She says, "I'm planning to open a coffee shop in a neighborhood that doesn't currently have one. It's a fantastic investment opportunity! I need to borrow $50,000 from you to start the business. In return, I'11 start repaying you two years from now. Here's the repayment plan: $10,000 in the second year, $10,000 in the third year, $15,000 in the fourth year, $15,000 in the fifth year, and $10,000 in the sixth year. So, in total, I'1l be returning $60,000, which means you'll earn an extra $10,000 over the principal amount as a token of my gratitude." You trust Jane and are confident she wouldn't abscond with the $50,000. However, you're left pondering if it's a fair deal for you. The interest rate she would qualify for the project was 10%. 1) Calculate the present value of the expected cash flows. Does this deal seem fair to you? 2) What amount should you lend to ensure this deal is fair for you? 3) At what interest rate would this deal be fair to you if the lending amount is kept at $50,000 ? Question 2: VN 2T3P1RFXPW37H660.New 2023 Toyota RAV4 XLE AWD Automatic. TSAP \$35,413. APR: For After viewing the ad shown above, you visited a local car dealership. You are about to close a deal at $35,413 as the purchase price for the vehicle. Your dealer says, "Okay, I understand that you need to finance your purchase with a loan. You are qualified for the advertised 3.99% APR for 4 years. The required minimum down payment is 20%." 1) What would the monthly loan payment be with a 20% down payment? And with down payments of 25%,30%, and 40% ? 2) The dealer continues: "With a 20% down payment, here is the contract form for your review and signature. The monthly amount includes additional fees and charges." On the document, you see the monthly loan payment is listed as $660 for 4 years. In present value terms, how much is the "fees and charges"? BUS314_EXCEL1 DUE 1011 (1) [Protected View] - Excel File Home Insert Page Layout Formulas Data Review View Q Tell me what you want to do... PROTECTED... Be carefulfiles from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing E7 A B fx \begin{tabular}{l|c|} \hline 1 & A \\ \hline 2 & Question 1: \end{tabular} Annualinterestrate10.00% \begin{tabular}{|l|c|} \hline & 0 \\ \hline Payments & \\ \hline Present value of each payment & \\ \hline Sum of present values & \\ \hline 1) Is it fair, or not fair? & \\ \hline 2) Fair amount to lend at 10\%: & \\ \hline 3)Lend$50,000ifinterestratewas: & \\ \hline \end{tabular} was: Question 2: \begin{tabular}{|l|l|} \hline Purchase price & \\ \hline Interest rate (APR) & \\ \hline Monthly interest rate & \\ \hline Payment months & \\ \hline \end{tabular} APR Monthly months 1) Monthly loan payment \begin{tabular}{|c|c|c|c|c|} \hline Down payment (\%) & 20% & 25% & 30% & 40% \\ \hline Down payment (\$) & & & & \\ \hline Loan amount (\$) & & & & \\ \hline Monthly payment (\$) & & & & \\ \hline \end{tabular} 2) Fees and charges \begin{tabular}{|c|c|} \hline Monthly amount calculated & \\ \hline Actual amount on the contract & \\ \hline Difference & \\ (Monthly fees and charges) & \\ \hline PV of monthly fees and charges & \\ \hline \end{tabular} Ready Sheet 1 \# Type here to search w x K L M N Q R S , \begin{tabular}{|l|l|l|} \hline 4 & 5 & 6 \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline APR \\ \hline Monthly \\ \hline months \\ \hline \end{tabular} Question 1: Your neighbor, Jane, approaches you with a proposal. She says, "I'm planning to open a coffee shop in a neighborhood that doesn't currently have one. It's a fantastic investment opportunity! I need to borrow $50,000 from you to start the business. In return, I'11 start repaying you two years from now. Here's the repayment plan: $10,000 in the second year, $10,000 in the third year, $15,000 in the fourth year, $15,000 in the fifth year, and $10,000 in the sixth year. So, in total, I'1l be returning $60,000, which means you'll earn an extra $10,000 over the principal amount as a token of my gratitude." You trust Jane and are confident she wouldn't abscond with the $50,000. However, you're left pondering if it's a fair deal for you. The interest rate she would qualify for the project was 10%. 1) Calculate the present value of the expected cash flows. Does this deal seem fair to you? 2) What amount should you lend to ensure this deal is fair for you? 3) At what interest rate would this deal be fair to you if the lending amount is kept at $50,000 ? Question 2: VN 2T3P1RFXPW37H660.New 2023 Toyota RAV4 XLE AWD Automatic. TSAP \$35,413. APR: For After viewing the ad shown above, you visited a local car dealership. You are about to close a deal at $35,413 as the purchase price for the vehicle. Your dealer says, "Okay, I understand that you need to finance your purchase with a loan. You are qualified for the advertised 3.99% APR for 4 years. The required minimum down payment is 20%." 1) What would the monthly loan payment be with a 20% down payment? And with down payments of 25%,30%, and 40% ? 2) The dealer continues: "With a 20% down payment, here is the contract form for your review and signature. The monthly amount includes additional fees and charges." On the document, you see the monthly loan payment is listed as $660 for 4 years. In present value terms, how much is the "fees and charges

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts