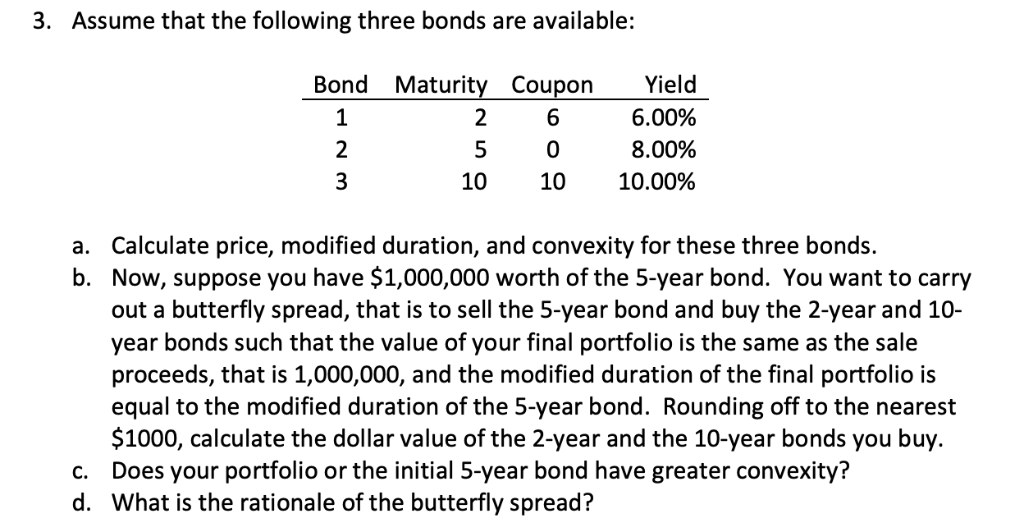

Question: (please show formulas if using excel) 3. Assume that the following three bonds are available: Bond Maturity Coupon Yield 6.00% 508.00% 10 10 10.00% 2

(please show formulas if using excel)

(please show formulas if using excel)

3. Assume that the following three bonds are available: Bond Maturity Coupon Yield 6.00% 508.00% 10 10 10.00% 2 a. Calculate price, modified duration, and convexity for these three bonds. b. Now, suppose you have $1,000,000 worth of the 5-year bond. You want to carry out a butterfly spread, that is to sell the 5-year bond and buy the 2-year and 10- year bonds such that the value of your final portfolio is the same as the sale proceeds, that is 1,000,000, and the modified duration of the final portfolio is equal to the modified duration of the 5-year bond. Rounding off to the nearest 1000, calculate the dollar value of the 2-year and the 10-year bonds you buy. Does your portfolio or the initial 5-year bond have greater convexity? What is the rationale of the butterfly spread? c. d. 3. Assume that the following three bonds are available: Bond Maturity Coupon Yield 6.00% 508.00% 10 10 10.00% 2 a. Calculate price, modified duration, and convexity for these three bonds. b. Now, suppose you have $1,000,000 worth of the 5-year bond. You want to carry out a butterfly spread, that is to sell the 5-year bond and buy the 2-year and 10- year bonds such that the value of your final portfolio is the same as the sale proceeds, that is 1,000,000, and the modified duration of the final portfolio is equal to the modified duration of the 5-year bond. Rounding off to the nearest 1000, calculate the dollar value of the 2-year and the 10-year bonds you buy. Does your portfolio or the initial 5-year bond have greater convexity? What is the rationale of the butterfly spread? c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts