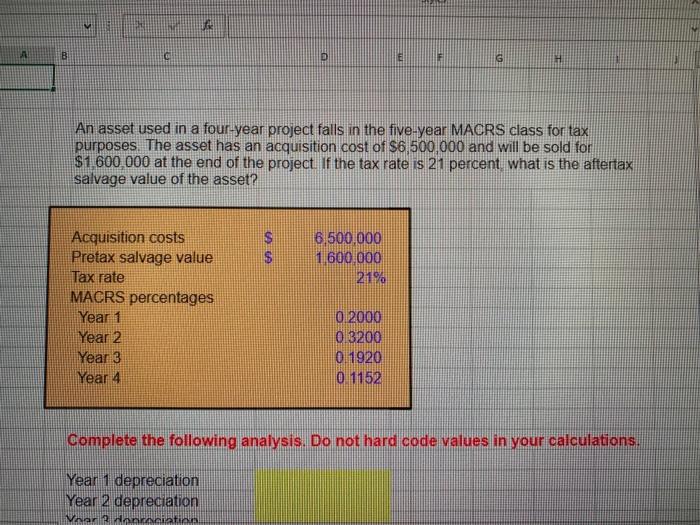

Question: please show formulas in excel. i will give thimbs up. A B C G H An asset used in a four-year project falls in the

please show formulas in excel. i will give thimbs up.

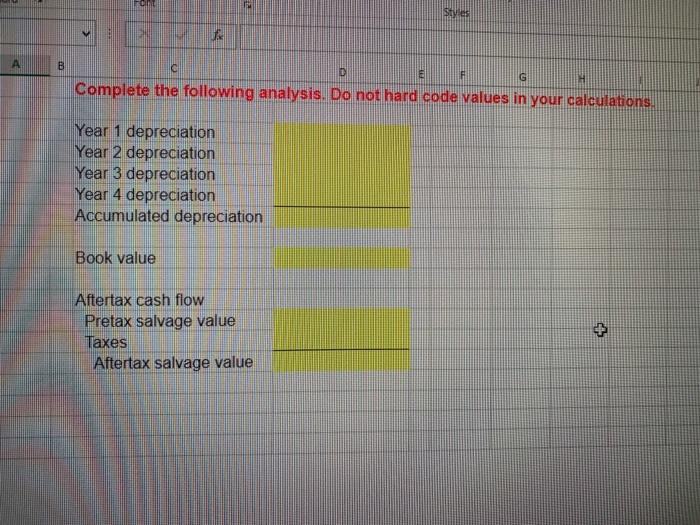

please show formulas in excel. i will give thimbs up.A B C G H An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,500,000 and will be sold for $1.600,000 at the end of the project. If the tax rate is 21 percent what is the aftertax salvage value of the asset? S $ 6.500.000 1600.000 21% Acquisition costs Pretax salvage value Tax rate MACRS percentages Year 1 Year 2 Year 3 Year 4 0 2000 0 3200 0 1920 0 1152 Complete the following analysis. Do not hard code values in your calculations. Year 1 depreciation Year 2 depreciation Vaari banditia ant Styles A B C G Complete the following analysis. Do not hard code values in your calculations. Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation Accumulated depreciation Book value Aftertax cash flow Pretax salvage value Taxes Aftertax salvage value +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts