Question: Please show formulas Problem 9-28 Your company has been doing well, reaching $1 million in eamings, and is considering launching a new product. Designing the

Please show formulas

Please show formulas

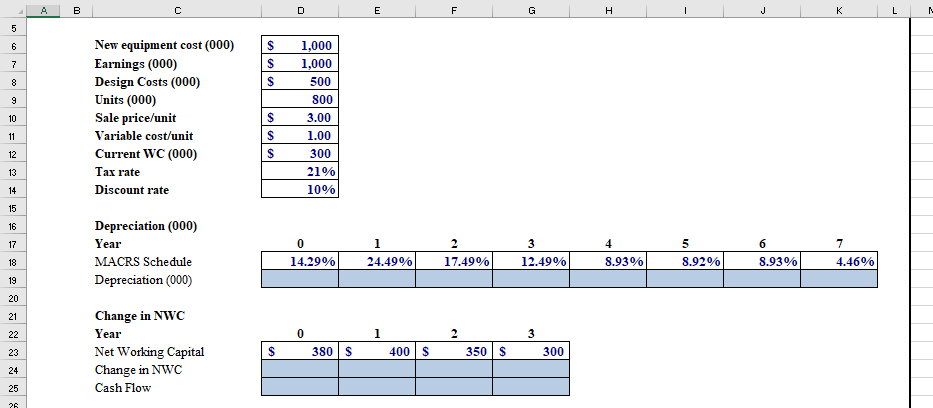

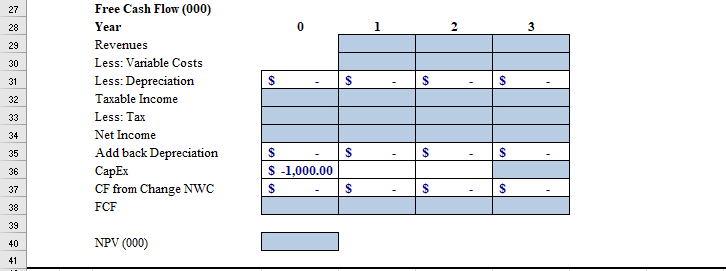

Problem 9-28 Your company has been doing well, reaching $1 million in eamings, and is considering launching a new product. Designing the new product has already cost $500,000. The company estimates that it will sell 800.000 units per year for $3 per unit and variable non-labor costs will be $1 per unit. Production will end after year 3. New equipment costing $1 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $300,000. The new product will require the working capital to increase to a level of $380,000 immediately, then to $400,000 in year 1, in year 2 the level will be $350,000, and finally in year 3 the level will retum to $300,000. Your tax rate is 21%. The discount rate for this project is 10%. Do the capital budgeting analysis for this project and calculate its NPV. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need to copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in vour formulas, usually the Given Data section A B C D E F G H 1 J L 5 6 7 S $ $ 8 9 10 New equipment cost (000) Earnings (000) Design Costs (000) Units (000) Sale price/unit Variable cost/unit Current WC (000) Tax rate Discount rate 1,000 1,000 500 800 3.00 1.00 300 21% 10% S $ S 11 12 13 14 15 16 17 0 6 7 Depreciation (000) Year MACRS Schedule Depreciation (000) 1 24.49% 2 17.49% 3 12.49% 4 8.93% 5 8.92% 18 14.29% 8.93% 4.46% 19 20 21 22 0 1 2 Change in NWC Year Net Working Capital Change in NWC Cash Flow 3 300 23 S 380 $ 400 S 350 $ 24 25 26 27 1 3 28 29 30 31 $ $ 32 Free Cash Flow (000) Year Revenues Less: Variable Costs Less: Depreciation Taxable income Less: Tax Net Income Add back Depreciation CapEx CF from Change NWC FCF 33 34 35 $ 36 $ $ -1,000.00 $ 37 $ S 38 39 40 NPV (000) 41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts