Question: Please show full solution so that I can understand each steps. No computer generated answers please. 9. London Tunnels Plc is bidding for a project

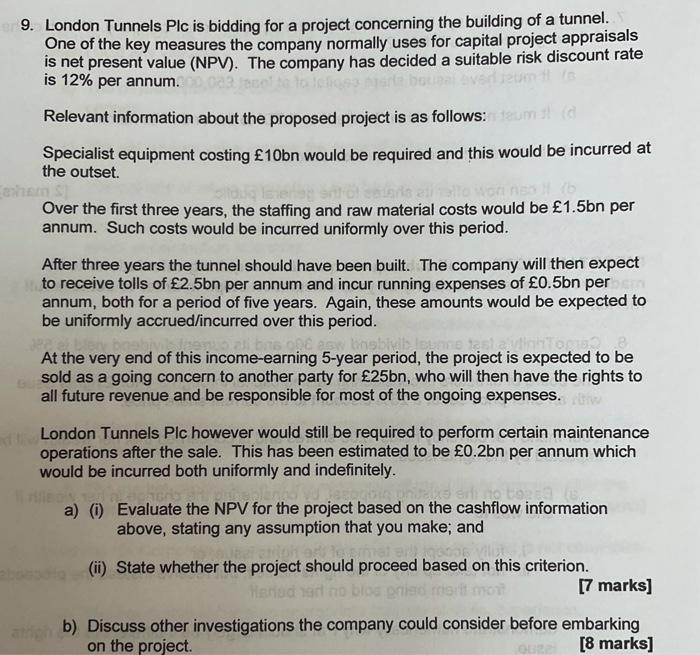

9. London Tunnels Plc is bidding for a project concerning the building of a tunnel. One of the key measures the company normally uses for capital project appraisals is net present value (NPV). The company has decided a suitable risk discount rate is 12% per annum. Relevant information about the proposed project is as follows:cum Specialist equipment costing 10bn would be required and this would be incurred at the outset. homs Over the first three years, the staffing and raw material costs would be 1.5bn per annum. Such costs would be incurred uniformly over this period. After three years the tunnel should have been built. The company will then expect to receive tolls of 2.5bn per annum and incur running expenses of 0.5bn perm annum, both for a period of five years. Again, these amounts would be expected to be uniformly accrued/incurred over this period. bel At the very end of this income-earning 5-year period, the project is expected to be sold as a going concern to another party for 25bn, who will then have the rights to all future revenue and be responsible for most of the ongoing expenses. London Tunnels Plc however would still be required to perform certain maintenance operations after the sale. This has been estimated to be 0.2bn per annum which would be incurred both uniformly and indefinitely. a) 0 Evaluate the NPV for the project based on the cashflow information above, stating any assumption that you make; and (i) State whether the project should proceed based on this criterion. [7 marks] b) Discuss other investigations the company could consider before embarking on the project [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts