Question: Please show full solution to problem 9.27 Sonar warning devices are being purchased by the St. James department store chain to help trucks back up

Please show full solution to problem

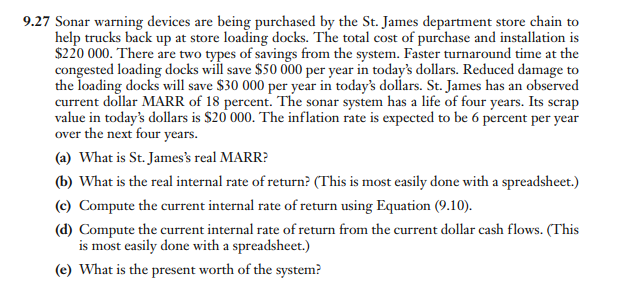

9.27 Sonar warning devices are being purchased by the St. James department store chain to help trucks back up at store loading docks. The total cost of purchase and installation is $220 000. There are two types of savings from the system. Faster turnaround time at the congested loading docks will save $50 000 per year in today's dollars. Reduced damage to the loading docks will save $30 000 per year in today's dollars. St. James has an observed current dollar MARR of 18 percent. The sonar system has a life of four years. Its scrap value in today's dollars is $20 000. The inflation rate is expected to be 6 percent per year over the next four years (a) What is St. James's real MARR? (b) What is the real internal rate of return? (This is most easily done with a spreadsheet.) (c) Compute the current internal rate of return using Equation (9.10) (d) Compute the current internal rate of return from the current dollar cash flows. (This is most easily done with a spreadsheet.) (e) What is the present worth of the system? 9.27 Sonar warning devices are being purchased by the St. James department store chain to help trucks back up at store loading docks. The total cost of purchase and installation is $220 000. There are two types of savings from the system. Faster turnaround time at the congested loading docks will save $50 000 per year in today's dollars. Reduced damage to the loading docks will save $30 000 per year in today's dollars. St. James has an observed current dollar MARR of 18 percent. The sonar system has a life of four years. Its scrap value in today's dollars is $20 000. The inflation rate is expected to be 6 percent per year over the next four years (a) What is St. James's real MARR? (b) What is the real internal rate of return? (This is most easily done with a spreadsheet.) (c) Compute the current internal rate of return using Equation (9.10) (d) Compute the current internal rate of return from the current dollar cash flows. (This is most easily done with a spreadsheet.) (e) What is the present worth of the system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts