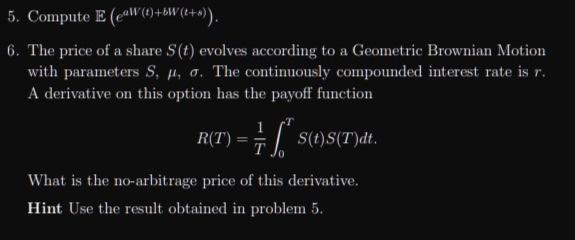

Question: please show full working. question 5 and 6 5. Compute E (4W (6) +6W (-+). 6. The price of a share S(t) evolves according to

5. Compute E (4W (6) +6W (-+). 6. The price of a share S(t) evolves according to a Geometric Brownian Motion with parameters S, H, 0. The continuously compounded interest rate is r. A derivative on this option has the payoff function R(T) = + L SC)S(T)dt. What is the no-arbitrage price of this derivative. Hint Use the result obtained in problem 5. 5. Compute E (4W (6) +6W (-+). 6. The price of a share S(t) evolves according to a Geometric Brownian Motion with parameters S, H, 0. The continuously compounded interest rate is r. A derivative on this option has the payoff function R(T) = + L SC)S(T)dt. What is the no-arbitrage price of this derivative. Hint Use the result obtained in problem 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts