Question: Please show FULL working. thanks :) Question Two (30 Marks) You plan to retire in 40 years and need to accumulate sufficient savings / investments

Please show FULL working. thanks :)

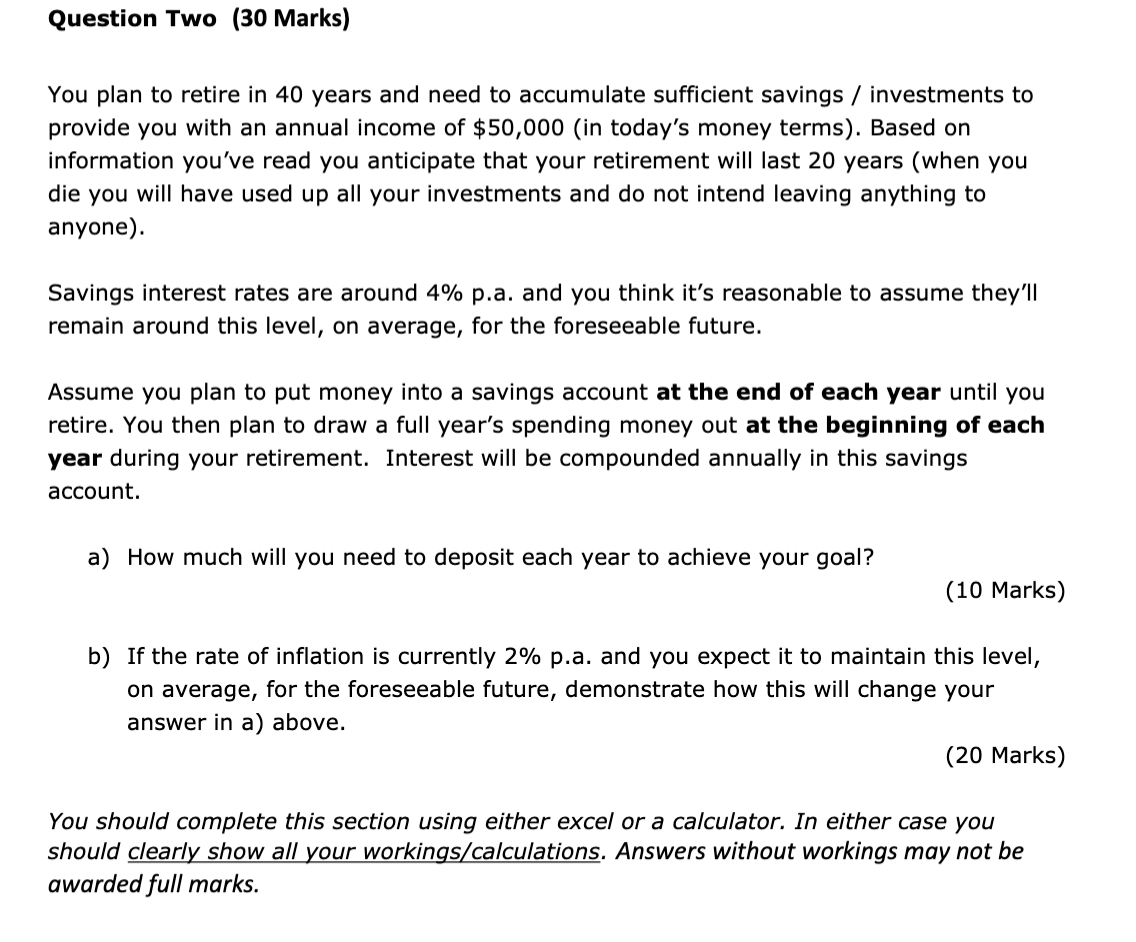

Question Two (30 Marks) You plan to retire in 40 years and need to accumulate sufficient savings / investments to provide you with an annual income of $50,000 (in today's money terms). Based on information you've read you anticipate that your retirement will last 20 years (when you die you will have used up all your investments and do not intend leaving anything to anyone). Savings interest rates are around 4% p.a. and you think it's reasonable to assume they'll remain around this level, on average, for the foreseeable future. Assume you plan to put money into a savings account at the end of each year until you retire. You then plan to draw a full year's spending money out at the beginning of each year during your retirement. Interest will be compounded annually in this savings account. a) How much will you need to deposit each year to achieve your goal? (10 Marks) b) If the rate of inflation is currently 2% p.a. and you expect it to maintain this level, on average, for the foreseeable future, demonstrate how this will change your answer in a) above. (20 Marks) You should complete this section using either excel or a calculator. In either case you should clearly show all your workings/calculations. Answers without workings may not be awarded full marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts