Question: Please show hand-written procedure don't use excel Problem 2: A package delivery company is considering purchasing a new cargo plane (Class 372) to expand the

Please show hand-written procedure don't use excel

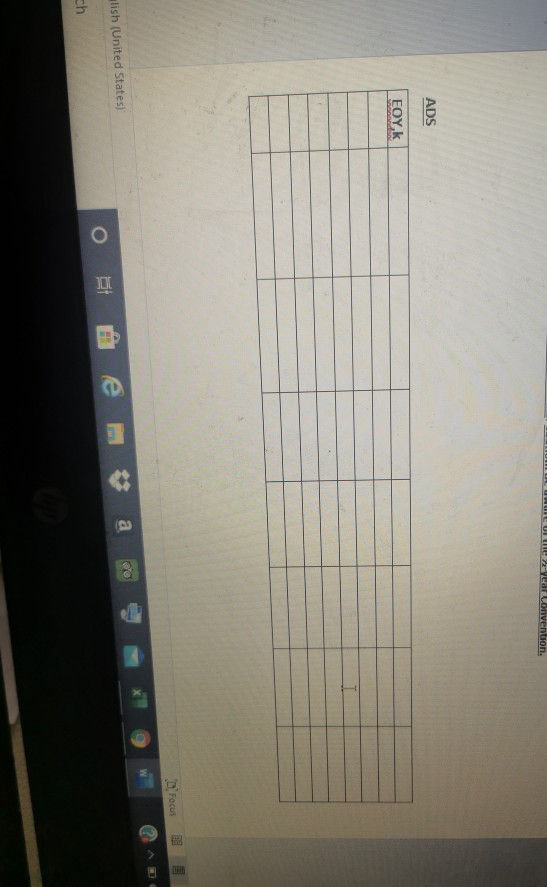

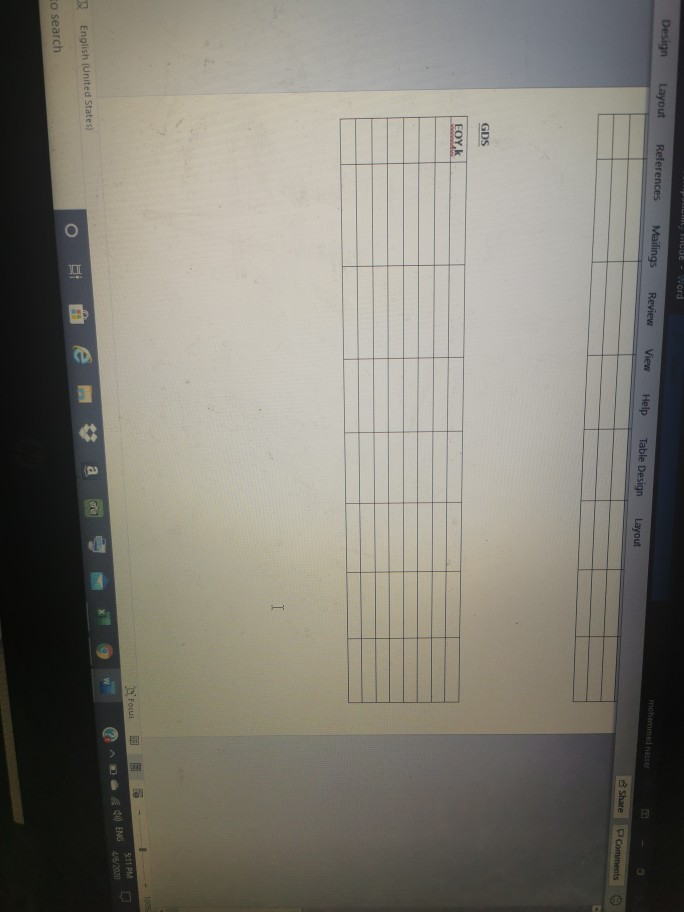

Problem 2: A package delivery company is considering purchasing a new cargo plane (Class 372) to expand the range and timeliness of its delivery business. The new plane has a purchase price of $4.1 million. It will also be required to increase Working Capital by $850,000. The company's projections estimate that the Operating Income (Revenues minus Expenses) will be $630,000 in the first year and increase by 4% each year. They plan to sell the plane after 4 years at an expected Market Value of $2.5 million. The company uses a Before Tax MARR of 20.34% and pays 35.869% in Federal Taxes and 8% in State Taxes. Both MACRS GDS and ADS methods of depreciation can be used Performan After-Tax Cash Flow (ATCE) Analysis for each of these methods in order to advise the company on which method of depreciation they should select. Fill in the tables below for each. You must obtain the PW amounts of each of the ATCF's to select only one method Show all cakulations. Caution: Be aware of the year Convention FOY Problem 2: A package-delivery company is considering purchasing a new cargo plane (Class 37.2) to expand the range and timeliness of its delivery business. The new plane has a purchase price of $4.1 million. It will also be required to increase Working Capital by $850,000. The company's projections estimate that the Operating Income (Revenues minus Expenses) will be $630,000 in the first year and increase by 49 each year. They plan to sell the plane after 4 years at an expected Market Value of $2.5 million. The company uses a Before-Tax MARR of 20.34% and pays 35.869% in Federal Taxes and 8% in State Taxes. Both MACRS GDS and ADS methods of depreciation can be used. Perform an After Tax Cash Flow (ATCE) Analysis for each of these methods in order to advise the company on which method of depreciation they should select. Fill in the tables below for each. You must obtain the PW amounts of each of the ATCF's to select only one method. Show all calculations. Caution: Be aware of the year Convention, L ue U -Year Lonvention. ADS EOY D. Focus a alish (United States) of 6 e ch Woord Design Layout References Mailings Review View Help Table Design Layout Share Comments GDS FOY K Focus E- 3:11 PM Q ^ D 0 ENG 118/2020 English (United States) to search Problem 2: A package delivery company is considering purchasing a new cargo plane (Class 372) to expand the range and timeliness of its delivery business. The new plane has a purchase price of $4.1 million. It will also be required to increase Working Capital by $850,000. The company's projections estimate that the Operating Income (Revenues minus Expenses) will be $630,000 in the first year and increase by 4% each year. They plan to sell the plane after 4 years at an expected Market Value of $2.5 million. The company uses a Before Tax MARR of 20.34% and pays 35.869% in Federal Taxes and 8% in State Taxes. Both MACRS GDS and ADS methods of depreciation can be used Performan After-Tax Cash Flow (ATCE) Analysis for each of these methods in order to advise the company on which method of depreciation they should select. Fill in the tables below for each. You must obtain the PW amounts of each of the ATCF's to select only one method Show all cakulations. Caution: Be aware of the year Convention FOY Problem 2: A package-delivery company is considering purchasing a new cargo plane (Class 37.2) to expand the range and timeliness of its delivery business. The new plane has a purchase price of $4.1 million. It will also be required to increase Working Capital by $850,000. The company's projections estimate that the Operating Income (Revenues minus Expenses) will be $630,000 in the first year and increase by 49 each year. They plan to sell the plane after 4 years at an expected Market Value of $2.5 million. The company uses a Before-Tax MARR of 20.34% and pays 35.869% in Federal Taxes and 8% in State Taxes. Both MACRS GDS and ADS methods of depreciation can be used. Perform an After Tax Cash Flow (ATCE) Analysis for each of these methods in order to advise the company on which method of depreciation they should select. Fill in the tables below for each. You must obtain the PW amounts of each of the ATCF's to select only one method. Show all calculations. Caution: Be aware of the year Convention, L ue U -Year Lonvention. ADS EOY D. Focus a alish (United States) of 6 e ch Woord Design Layout References Mailings Review View Help Table Design Layout Share Comments GDS FOY K Focus E- 3:11 PM Q ^ D 0 ENG 118/2020 English (United States) to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts