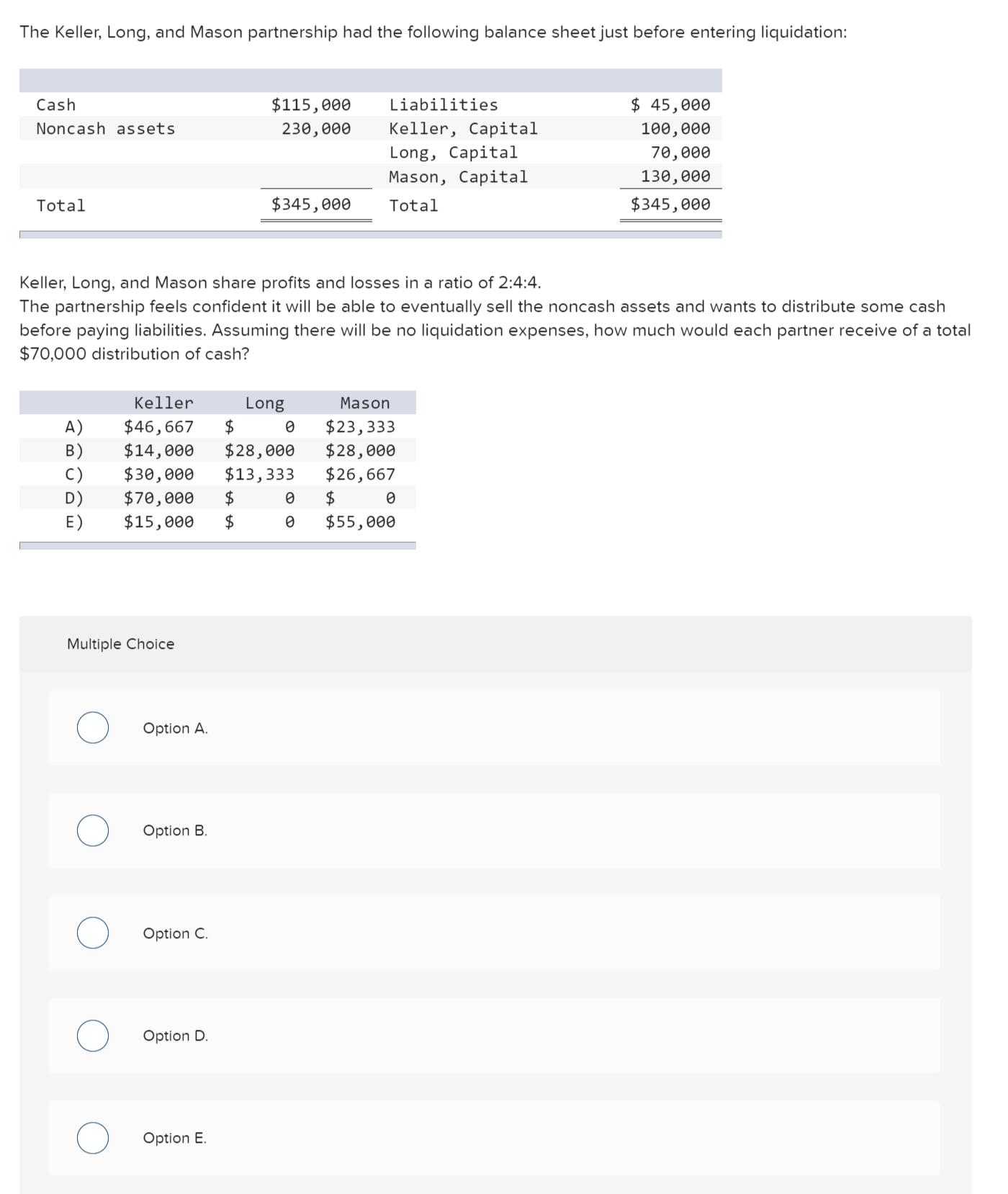

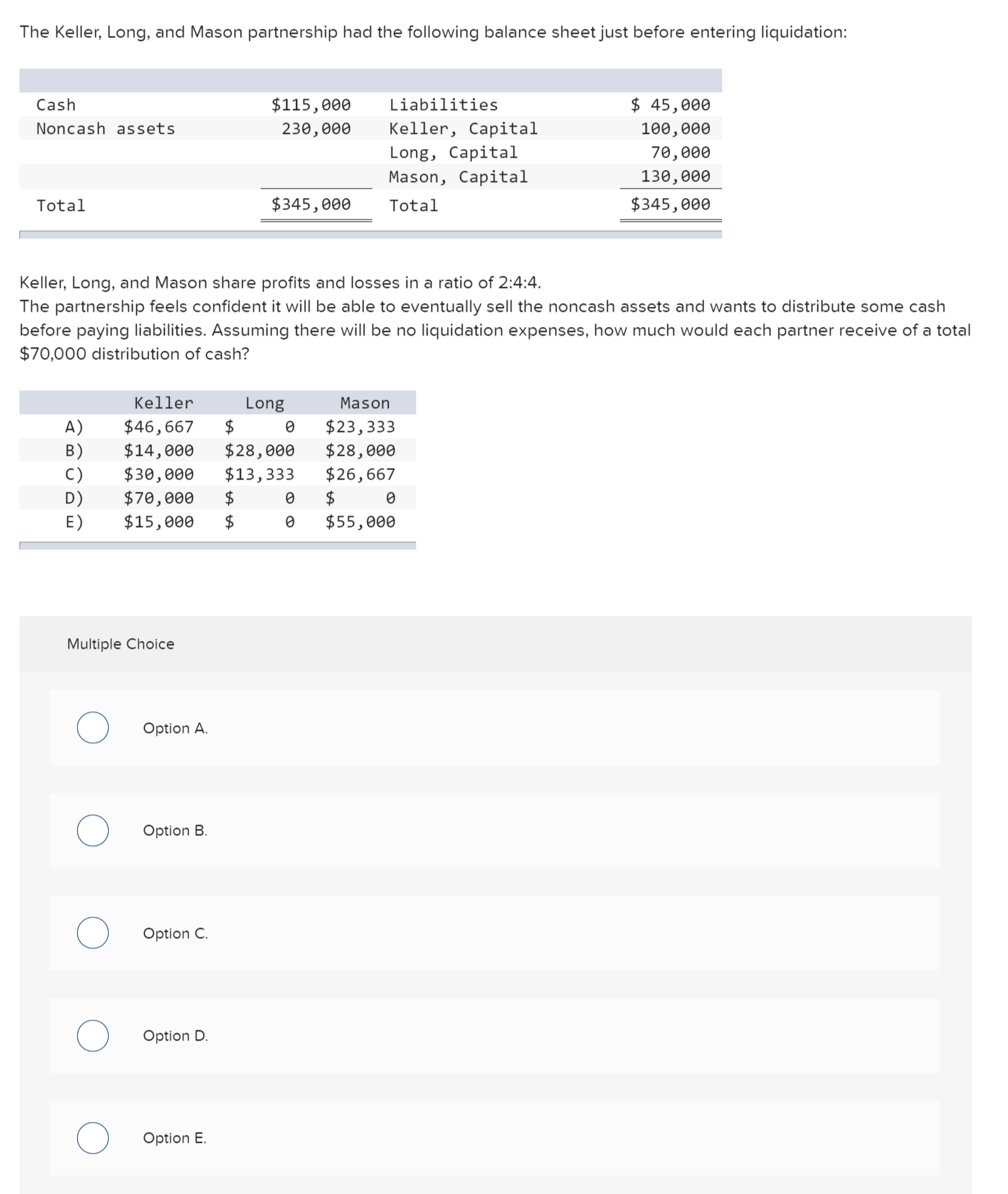

Question: please show how answer is derived The Keller. Long, and Mason partnership had the following balance sheetjust before entering liquidation: Cash $115,666 Liabilities $ 45,666

please show how answer is derived

The Keller. Long, and Mason partnership had the following balance sheetjust before entering liquidation: Cash $115,666 Liabilities $ 45,666 Noncash assets 236,666 Keller, Capital 166,666 Long, Capital 76,666 Mason, Capital 136,666 Total $345,666 Total $345,666 ' Keller. Long, and Mason share profits and losses in a ratio of 2:4:4. The partnership feels confident it will be able to eventually sell the noncash assets and wants to distribute some cash before paying liabilities. Assuming there will be no liquidation expenses. how much would each partner receive of a total $70,000 distribution of cash? Keller Long Mason A) $46,667 $ 6 $23,333 B) $14,666 $28,666 $28,666 C) $36,666 $13,333 $26,667 D) $79,666 $ 9 s e E) $15,666 $ 6 $55,666 ' Multiple Choice 0 Option A. Option 3. Option C. Option D. Option E. 0000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts