Question: please show how its done in exel. You work for an nationally charter bank and have been asked to project adjustable rate mortgage (ARM) interest

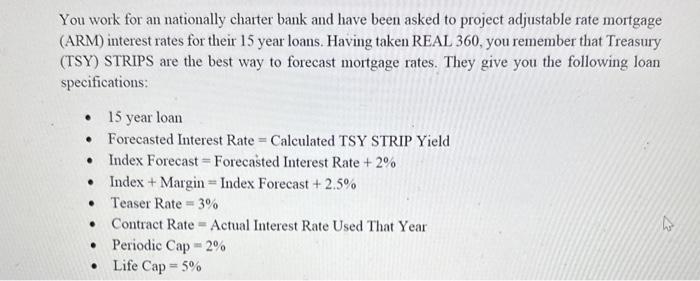

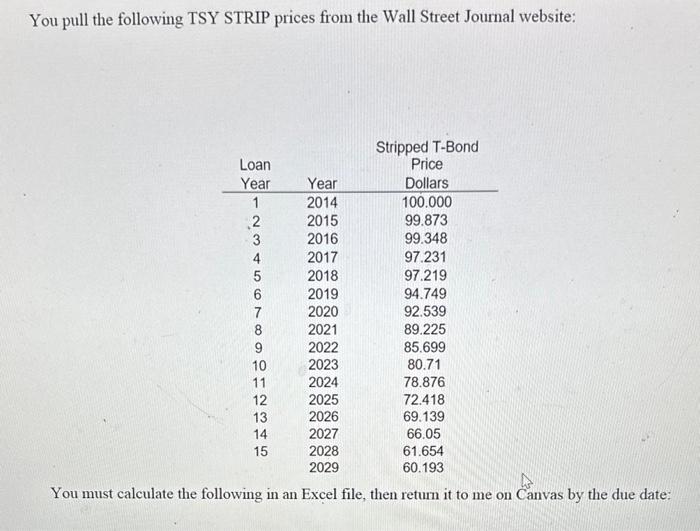

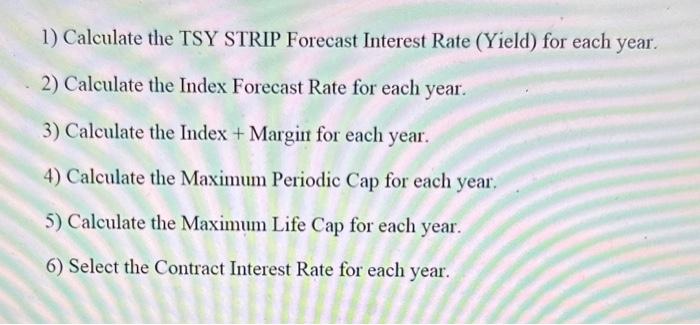

You work for an nationally charter bank and have been asked to project adjustable rate mortgage (ARM) interest rates for their 15 year loans. Having taken REAL 360 , you remember that Treasury (TSY) STRIPS are the best way to forecast mortgage rates. They give you the following loan specifications: - 15 year loan - Forecasted Interest Rate = Calculated TSY STRIP Yield - Index Forecast = Forecasted Interest Rate +2% - Index + Margin = Index Forecast +2.5% - Teaser Rate =3% - Contract Rate = Actual Interest Rate Used That Year - Periodic Cap =2% - Life Cap =5% You pull the following TSY STRIP prices from the Wall Street Journal website: You must calculate the following in an Excel file, then return it to me on Canvas by the due date: 1) Calculate the TSY STRIP Forecast Interest Rate (Yield) for each year. 2) Calculate the Index Forecast Rate for each year. 3) Calculate the Index + Margin for each year. 4) Calculate the Maximum Periodic Cap for each year. 5) Calculate the Maximum Life Cap for each year. 6) Select the Contract Interest Rate for each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts