Question: please show how profit was calculated in final step ) You are cautiously bullish on the common stock of the Wildwood Corporation over the next

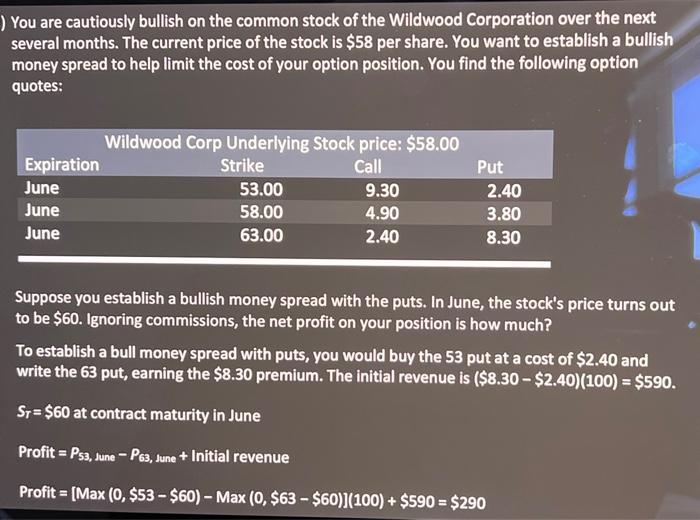

) You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $58 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes: Wildwood Corp Underlying Stock price: $58.00 Expiration Strike Call June 53.00 9.30 June 58.00 4.90 June 63.00 2.40 Put 2.40 3.80 8.30 Suppose you establish a bullish money spread with the puts. In June, the stock's price turns out to be $60. Ignoring commissions, the net profit on your position is how much? To establish a bull money spread with puts, you would buy the 53 put at a cost of $2.40 and write the 63 put, earning the $8.30 premium. The initial revenue is ($8.30 - $2.40)(100) = $590. Sy = $60 at contract maturity in June Profit = Ps3, June - P3, June + Initial revenue Profit = [Max (0, $53 - $60) - Max (0, $63 - $60)](100) + $590 = $290 ) You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $58 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes: Wildwood Corp Underlying Stock price: $58.00 Expiration Strike Call June 53.00 9.30 June 58.00 4.90 June 63.00 2.40 Put 2.40 3.80 8.30 Suppose you establish a bullish money spread with the puts. In June, the stock's price turns out to be $60. Ignoring commissions, the net profit on your position is how much? To establish a bull money spread with puts, you would buy the 53 put at a cost of $2.40 and write the 63 put, earning the $8.30 premium. The initial revenue is ($8.30 - $2.40)(100) = $590. Sy = $60 at contract maturity in June Profit = Ps3, June - P3, June + Initial revenue Profit = [Max (0, $53 - $60) - Max (0, $63 - $60)](100) + $590 = $290

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts