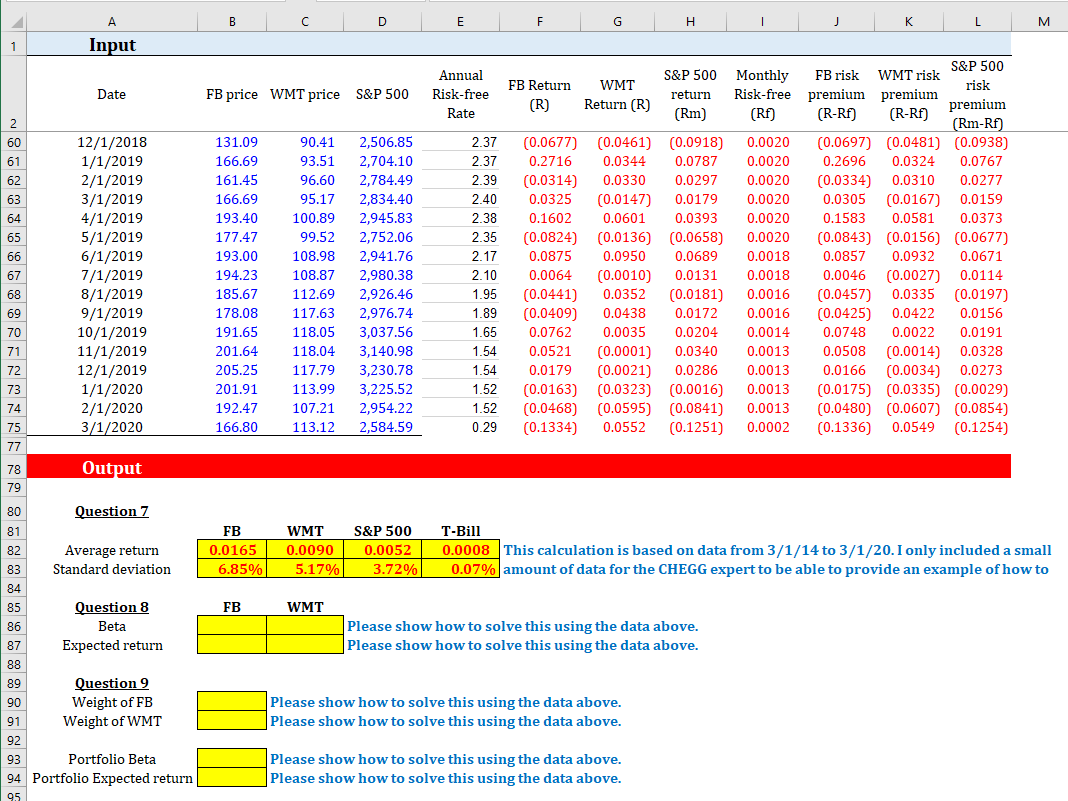

Question: Please show how to calculate question 8 & 9. Please ignore that calculations in question 7 because it is based on data from 3/1/14 to

Please show how to calculate question 8 & 9. Please ignore that calculations in question 7 because it is based on data from 3/1/14 to 3/1/20. I included a small sample of the data to get help on how to calculate 8 &9. .

D E F G H I J K L Input Date FB price WMT price S&P 500 Risk-free Rate FB Return (R) WMT Return (R) S&P 500 return (Rm) (0.0677) 12/1/2018 1/1/2019 2/1/2019 3/1/2019 4/1/2019 5/1/2019 6/1/2019 7/1/2019 8/1/2019 9/1/2019 10/1/2019 11/1/2019 12/1/2019 1/1/2020 2/1/2020 3/1/2020 131.09 166.69 161.45 166.69 193.40 177.47 193.00 194.23 185.67 178.08 191.65 201.64 205.25 201.91 192.47 166.80 90.41 2,506.85 93.51 2,704.10 96.60 2,784.49 95.17 2,834.40 100.89 2,945.83 99.52 2,752.06 108.98 2,941.76 108.87 2,980.38 112.69 2,926.46 117.63 2,976.74 118.05 3,037.56 118.04 3,140.98 117.793,230.78 113.99 3,225.52 107.21 2,954.22 113.12 2,584.59 2.37 2.37 2.39 2.40 2.38 2.35 2.17 2.10 1.95 1.89 1.65 1.54 1.54 1.52 1.52 0.29 (0.0314) 0.0325 0.1602 (0.0824) 0.0875 0.0064 (0.0441) (0.0409) 0.0762 0.0521 0.0179 (0.0163) (0.0468) (0.1334) (0.0461) 0.0344 0.0330 (0.0147) 0.0601 (0.0136) 0.0950 (0.0010) 0.0352 0.0438 0.0035 (0.0001) (0.0021) (0.0323) (0.0595) 0.0552 (0.0918) 0.0787 0.0297 0.0179 0.0393 (0.0658) 0.0689 0.0131 (0.0181) 0.0172 0.0204 0.0340 0.0286 (0.0016) (0.0841) (0.1251) Monthly FB risk WMT risk S&P 500 Risk-free premium risk premium (RF) (R-Rf) (R-RE) premium (Rm-Rf) 0.0020 (0.0697) (0.0481) (0.0938) 0.0020 0.2696 0.0324 0.0767 0.0020 (0.0334) 0.0310 0.0277 0.0020 0.0305 (0.0167) 0.0159 0.0020 0.1583 0.0581 0.0373 0.0020 (0.0843) (0.0156) (0.0677) 0.0018 0.0857 0.0932 0.0671 0.0018 0.0046 (0.0027) 0.0114 0.0016 (0.0457) 0.0335 (0.0197) 0.0016 (0.0425) 0.0422 0.0156 0.0014 0.0748 0.0022 0.0191 0.0013 0.0508 (0.0014) 0.0328 0.0013 0.0166 (0.0034) 0.0273 0.0013 (0.0175) (0.0335) (0.0029) 0.0013 (0.0480) (0.0607) (0.0854) 0.0002 0.1336) 0.0549 (0.1254) Output Question 7 FB Average return Standard deviation 0.0165 6.85% WMTS&P 500 0.0090 0.0052 5.17% 3.72% T-Bill 0.0008 This calculation is based on data from 3/1/14 to 3/1/20. I only included a small 0.07% amount of data for the CHEGG expert to be able to provide an example of how to FB WMT Question 8 Beta Expected return Please show how to solve this using the data above. Please show how to solve this using the data above. Question 9 Weight of FB Weight of WMT Please show how to solve this using the data above Please show how to solve this using the data above. Portfolio Beta 94 Portfolio Expected return Please show how to solve this using the data above. Please show how to solve this using the data above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts