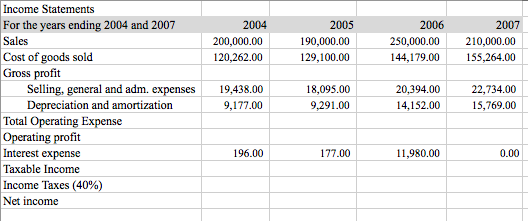

Question: PLEASE SHOW HOW TO DO IN EXCEL WITH STEPS: Requirement: Complete the Income statement with appropriate design including border, underline. Gross Profit = Sales Cost

PLEASE SHOW HOW TO DO IN EXCEL WITH STEPS:

Requirement:

Complete the Income statement with appropriate design including border, underline.

Gross Profit = Sales Cost of Goods Sold

Total Operating Expense = Selling, general and adm. Expenses+ Depreciation and amortization

Operating profit = Gross Profit - Total Operating Expense

Taxable Income = Operating profit- Interest expense

Income Taxes = Tax rate * taxable Income

Net income = Taxable Income - Income Taxes

Income Statements For the years ending 2004 and 2007 Sales Cost of goods sold Gross profft 2006 2007 2004 200,000.00 120,262.00 2005 190,000.00 129,100.00 250,000.00 210,000.00 144,179.00155,264.00 Selling, general and adm. expenses19.438.00 9,177.00 18,095.00 20,394.00 22,734.00 4,152.00 15,769.00 Depreciation and amortization 9,291.00 Total Operating Expense Operating profit Interest expense Taxable Income Income Taxes (40%) Net income 196.00 177.00 11,980.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts