Question: please show how to do it The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for

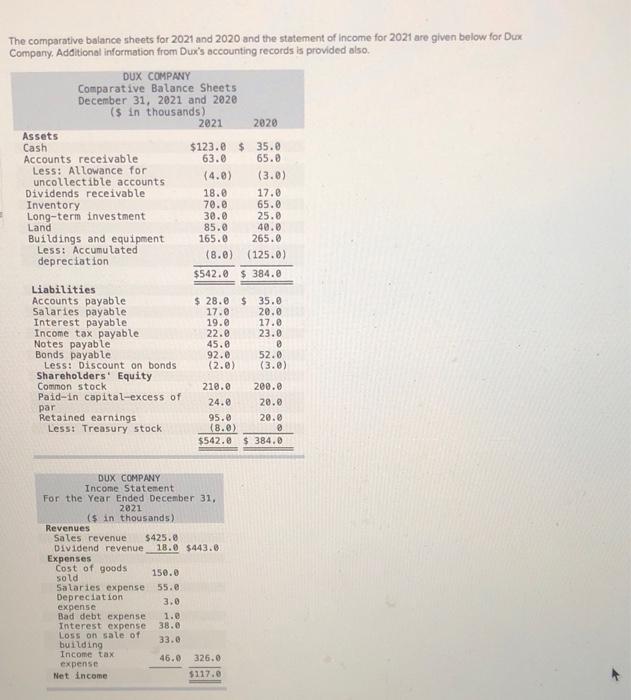

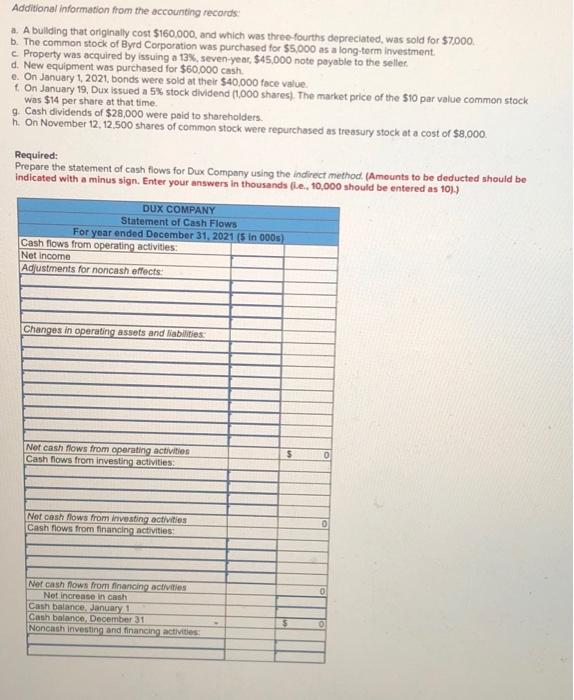

The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company, Additional information from Dux's accounting records is provided also. Additional information from the accounting records: a. A bullding that originally cost $160,000, and which was threefourths depreciated, was sold for 57,000 . b. The common stock of Byrd Corporation was purchased for $5,000 as a long-term investment. c. Property was acquired by issuing a 13%, seven-year, $45,000 note poyable to the seller. d. New equipment was purchased for $60,000 cash. e. On January 1, 2021, bonds were sold at their $40,000 face value. f. On January 19, Dux issued a 5% stock dividend (1,000 shares). The market price of the 510 par value common stock was $14 per share at that time. 9. Cash dividends of $28,000 were paid to shoreholders. h. On November 12, 12,500 shares of common stock were repurchased as treasury stock at a cost of $8,000. Required: Prepare the statement of cash fiows for Dux Company using the indirect method. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands (Le., 10,000 should be entered as 10).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts