Question: please show how to do journal entry C and D On April 1, 2019. Guy Comeau and Amelie Lavol formed a partnership in Ontario 2

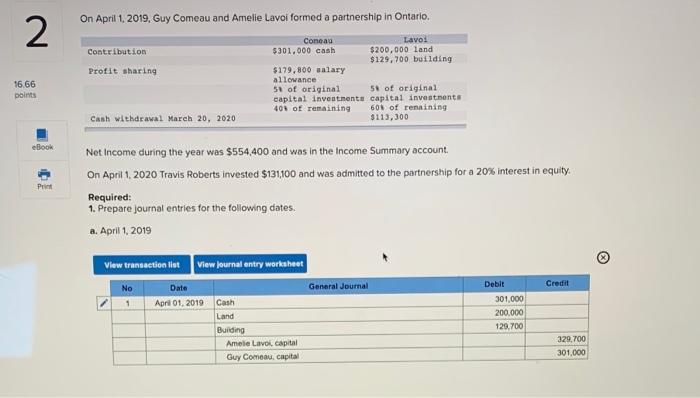

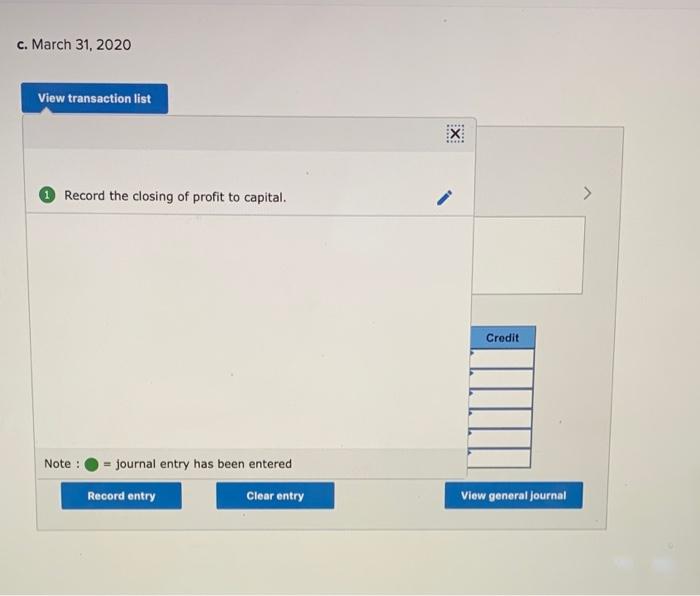

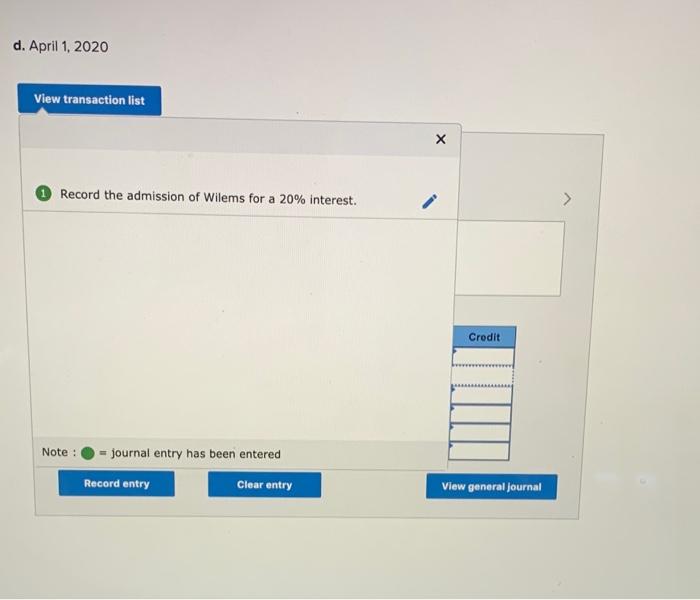

On April 1, 2019. Guy Comeau and Amelie Lavol formed a partnership in Ontario 2 Contribution Profit sharing 16.66 points Coneau Lavo: $301.000 cash $200,000 land $129,700 building $179,800 salary allowance 51 of original 51 of original capital investments capital investments 401 of remaining 60% of remaining $113,300 Cash withdrawal March 20, 2020 eBook a Punt Net Income during the year was $554,400 and was in the Income Summary account, On April 1, 2020 Travis Roberts invested $131100 and was admitted to the partnership for a 20% interest in equity. Required: 1. Prepare journal entries for the following dates. a. April 1, 2019 View transaction lit View Journal entry worksheet Data General Journal Credit No 1 April 01, 2019 Cash Land Buiding Amele Lavol capital Guy Comeau, capital Debit 301,000 200.000 129,700 329.700 301.000 c. March 31, 2020 View transaction list EX x Record the closing of profit to capital. > Credit Note : journal entry has been entered Record entry Clear entry View general Journal d. April 1, 2020 View transaction list Record the admission of Wilems for a 20% interest. > Crodit Note : journal entry has been entered Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts