Question: Please show how to do this with excel functions. 1 Question 5- IRR & NPV Points lost 2 3 You are considering two crowd-funding opportunities.

Please show how to do this with excel functions.

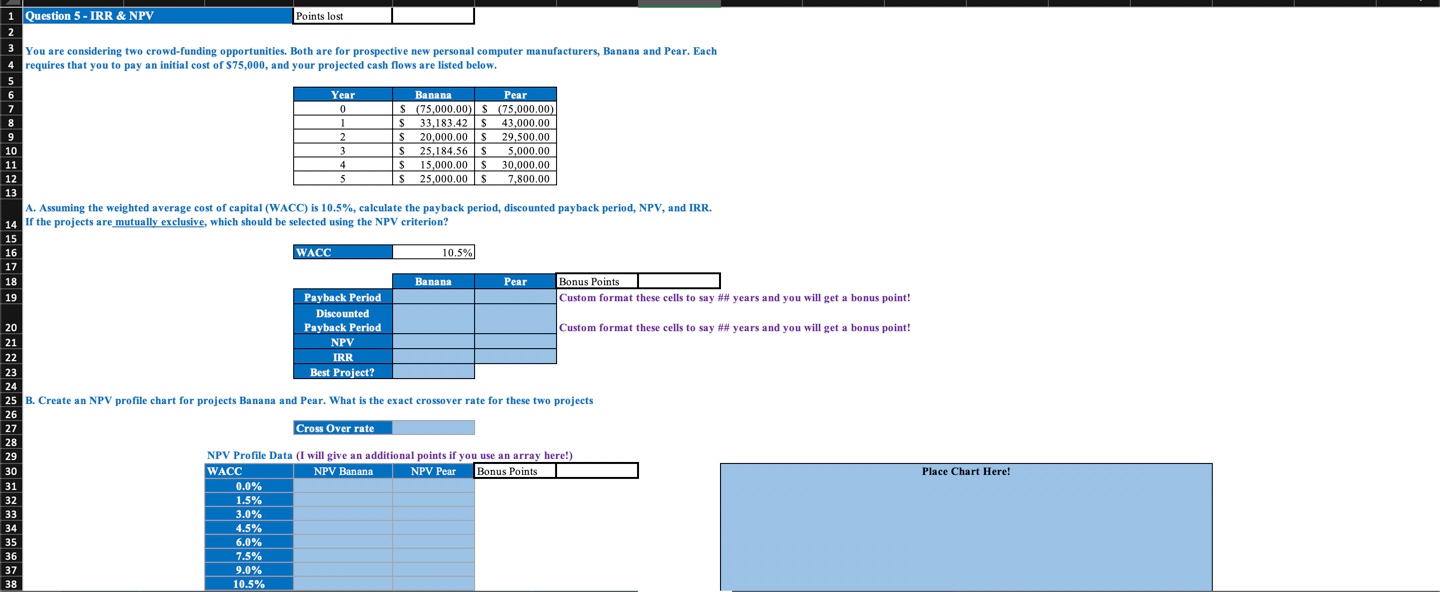

1 Question 5- IRR & NPV Points lost 2 3 You are considering two crowd-funding opportunities. Both are for prospective new personal computer manufacturers, Banana and Pear. Each 4 requires that you to pay an initial cost of $75,000, and your projected cash flows are listed below. 6 Year Banana Pear S (75,000.00) S (75,000.00) 33,183.42 43,000.00 20,000.00 S 25,184.56 S 7 0 8 1 9 2 29.500.00 10 3 S 5,000.00 30,000.00 11 4 15,000.00 25,000.00 S 12 5 S 7,800.00 13 A. Assuming the weighted average cost of capital (WACC) is 10.5 %, calculate the payback period, discounted payback period, NPV, and IRR. If the projects are mutually exclusive, which should be selected using the NPV criterion? 15 WACC 16 10.5% 17 Bonus Points 18 Banana Pear Custom format these cells to say # # years and you will get a bonus point! 19 Payback Period Discounted Custom format these cells to say ## years and you will get a bonus point! Payback Period 20 NPV 21 IRR 22 Best Project? 23 24 B. Create an NPV profile chart for projects Banana and Pear. What is the exact crossover rate for these two projects 26 Cross Over rate 27 28 NPV Profile Data (I will give an additional points if you use an array here!) WACC 29 NPV Banana NPV Pear Bonus Points Place Chart Here! 30 0.0% 31 1.5% 32 33 3.0% 34 4.5% 35 6.0% 36 7.5% 37 9.0% 38 10.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts