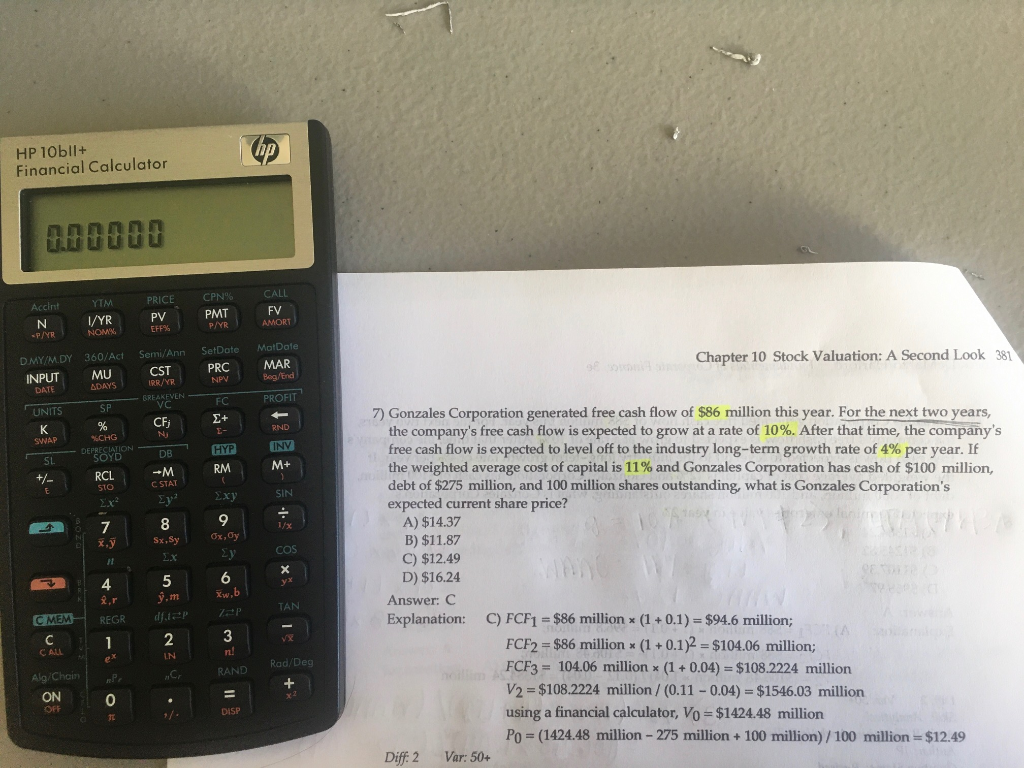

Question: Please show how to find V 0 =$1424.48 using a financial calculator (pictured). HP 10b1lt Financial Calculator DADO DE Accent N P/YR YTM 1/YR NOM

Please show how to find V0=$1424.48 using a financial calculator (pictured).

HP 10b1lt Financial Calculator DADO DE Accent N P/YR YTM 1/YR NOM PRICE PV EFF% CPN PMT P/YR CALL FV AMORT SetDote PRC MotDole MAR Bag/End 360/Act Semi/Ann MU CST IRR/YR Chapter 10 Stock Valuation: A Second Look 382 DMY/M DY INPUT DATE UNITS NPV ADAYS - BREAKEVEN - VC - FC PROFIT SP CFi + RND SWAP CHG DEPRECIATION INY SL HYP RM SOYD RCL STO M+ +M +/- CSTAT 72 Eya Sx, sy 9 Ox, Oy COS 6 4 7) Gonzales Corporation generated free cash flow of $86 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 10%. After that time, the company's free cash flow is expected to level off to the industry long-term growth rate of 4% per year. If the weighted average cost of capital is 11% and Gonzales Corporation has cash of $100 million, debt of $275 million, and 100 million shares outstanding, what is Gonzales Corporation's expected current share price? A) $14.37 B) $11.87 C) $12.49 D) $16.24 Answer: C Explanation: C) FCF1 = $86 million (1 + 0.1) - $94.6 million; FCF2 = $86 million *(1 + 0.1)2 = $104.06 million; FCF3 = 104.06 million * (1 + 0.04) = $108.2224 million V2 = $108.2224 million /(0.11 -0.04) = $1546.03 million using a financial calculator, Vo = $1424.48 million Po (1424.48 million - 275 million + 100 million)/100 million $12.49 Diff:2 Var: 50+ Xw.b 2 y.m TAN ZP C MEM REGR CALL IN Rad/Deg RAND Alg/Chain Pe O = DISP HP 10b1lt Financial Calculator DADO DE Accent N P/YR YTM 1/YR NOM PRICE PV EFF% CPN PMT P/YR CALL FV AMORT SetDote PRC MotDole MAR Bag/End 360/Act Semi/Ann MU CST IRR/YR Chapter 10 Stock Valuation: A Second Look 382 DMY/M DY INPUT DATE UNITS NPV ADAYS - BREAKEVEN - VC - FC PROFIT SP CFi + RND SWAP CHG DEPRECIATION INY SL HYP RM SOYD RCL STO M+ +M +/- CSTAT 72 Eya Sx, sy 9 Ox, Oy COS 6 4 7) Gonzales Corporation generated free cash flow of $86 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 10%. After that time, the company's free cash flow is expected to level off to the industry long-term growth rate of 4% per year. If the weighted average cost of capital is 11% and Gonzales Corporation has cash of $100 million, debt of $275 million, and 100 million shares outstanding, what is Gonzales Corporation's expected current share price? A) $14.37 B) $11.87 C) $12.49 D) $16.24 Answer: C Explanation: C) FCF1 = $86 million (1 + 0.1) - $94.6 million; FCF2 = $86 million *(1 + 0.1)2 = $104.06 million; FCF3 = 104.06 million * (1 + 0.04) = $108.2224 million V2 = $108.2224 million /(0.11 -0.04) = $1546.03 million using a financial calculator, Vo = $1424.48 million Po (1424.48 million - 275 million + 100 million)/100 million $12.49 Diff:2 Var: 50+ Xw.b 2 y.m TAN ZP C MEM REGR CALL IN Rad/Deg RAND Alg/Chain Pe O = DISP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts