Question: please show how to get the anwer using a financial calculator Bond prices. Price the bonds from the following table with semiannual coupon payments. Years

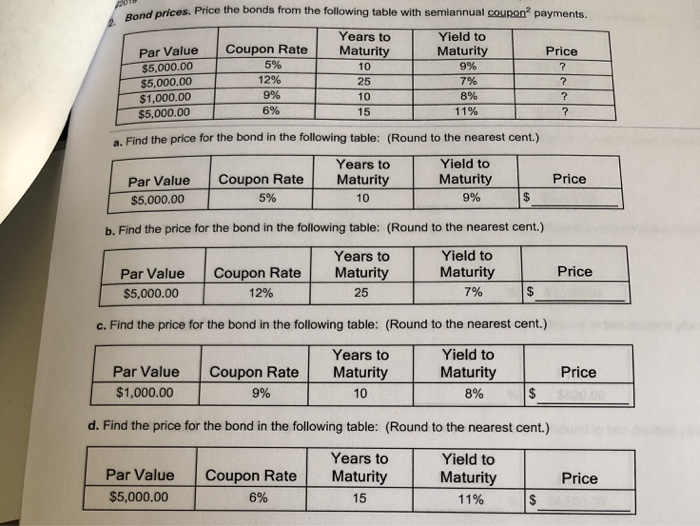

Bond prices. Price the bonds from the following table with semiannual coupon payments. Years to Yield to Coupon Rate Par Value $5,000.00 $5,000.00 $1,000.00 $5,000.00 Maturity Maturity Price 5% 10 9% 12% 25 7% ? 9% 8% 10 ? 6% 15 11% ? Find the price for the bond in the following table: (Round to the nearest cent.) Yield to Years to Coupon Rate Maturity Maturity Price Par Value 5% 10 9% $5,000.00 b. Find the price for the bond in the following table: (Round to the nearest cent.) Yield to Years to Price Coupon Rate Maturity Par Value Maturity 7% $5,000.00 12% 25 c. Find the price for the bond in the following table: (Round to the nearest cent.) Yield to Years to Coupon Rate Maturity Par Value Maturity Price $1,000.00 $ 9% 10 8% d. Find the price for the bond in the following table: (Round to the nearest cent.) Years to Yield to Par Value Coupon Rate Maturity Maturity Price $5,000.00 6% 15 11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts