Question: Please show how to get the correct answer shown above! Parson's pretax accounting income in Year 2 is $100,000. Parson deducts depreciation for tax purposes

Please show how to get the correct answer shown above!

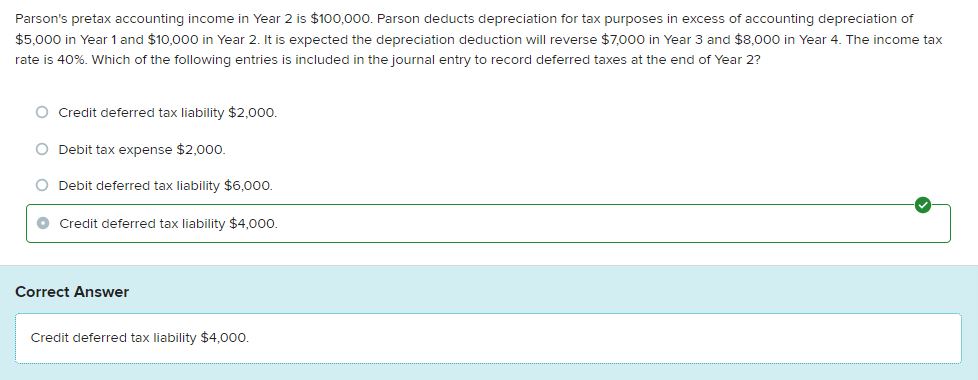

Parson's pretax accounting income in Year 2 is $100,000. Parson deducts depreciation for tax purposes in excess of accounting depreciation of $5,000 in Year 1 and $10,000 in Year 2. It is expected the depreciation deduction will reverse $7,000 in Year 3 and $8,000 in Year 4 . The income tax rate is 40%. Which of the following entries is included in the journal entry to record deferred taxes at the end of Year 2 ? Credit deferred tax liability $2,000. Debit tax expense $2,000. Debit deferred tax liability $6,000. Credit deferred tax liability $4,000. Correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts