Question: PLEASE SHOW HOW TO INPUT INTO A TI84 PLUS CE CALCULATOR Assume that your required rate of return is 12 percent and you are given

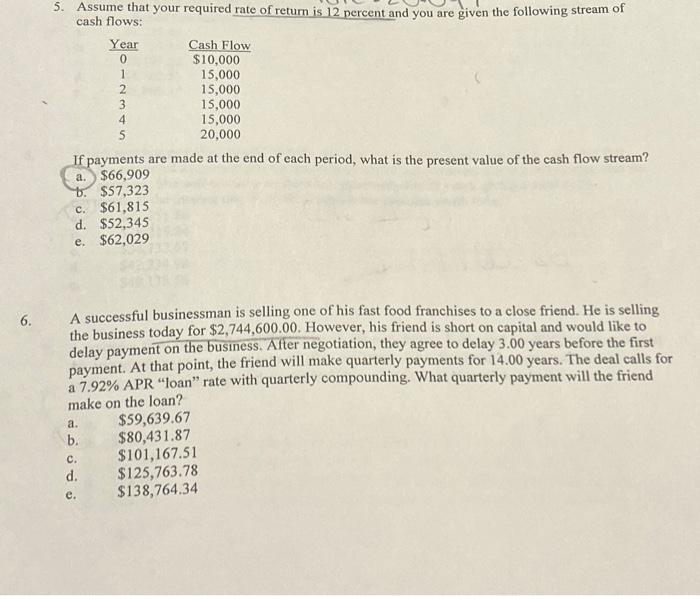

5. Assume that your required rate of return is 12 percent and you are given the following stream of cash flows: If payments are made at the end of each period, what is the present value of the cash flow stream? a. $66,909 b. $57,323 c. $61,815 d. $52,345 e. $62,029 A successful businessman is selling one of his fast food franchises to a close friend. He is selling the business today for $2,744,600.00. However, his friend is short on capital and would like to delay payment on the business. After negotiation, they agree to delay 3.00 years before the first payment. At that point, the friend will make quarterly payments for 14.00 years. The deal calls for a 7.92% APR "loan" rate with quarterly compounding. What quarterly payment will the friend make on the loan? a. $59,639.67 b. $80,431.87 c. $101,167.51 d. $125,763.78 e. $138,764.34 5. Assume that your required rate of return is 12 percent and you are given the following stream of cash flows: If payments are made at the end of each period, what is the present value of the cash flow stream? a. $66,909 b. $57,323 c. $61,815 d. $52,345 e. $62,029 A successful businessman is selling one of his fast food franchises to a close friend. He is selling the business today for $2,744,600.00. However, his friend is short on capital and would like to delay payment on the business. After negotiation, they agree to delay 3.00 years before the first payment. At that point, the friend will make quarterly payments for 14.00 years. The deal calls for a 7.92% APR "loan" rate with quarterly compounding. What quarterly payment will the friend make on the loan? a. $59,639.67 b. $80,431.87 c. $101,167.51 d. $125,763.78 e. $138,764.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts