Question: please show how to solve each question 1. Compute the Future Value of a $12,000 investment that will earn 13.50 percent compounded monthly over 8

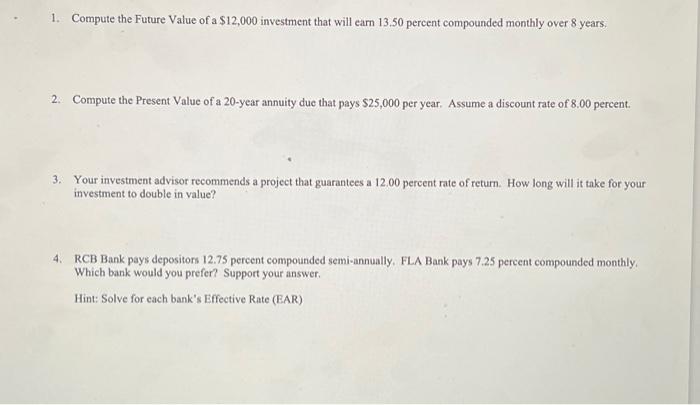

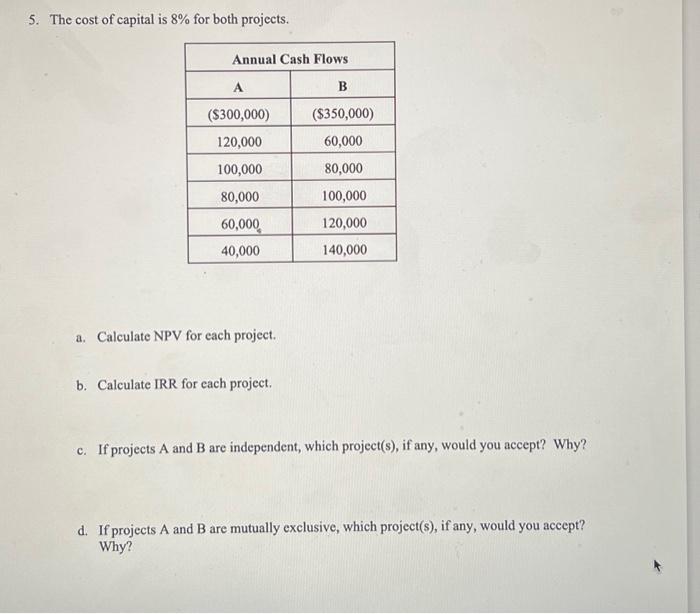

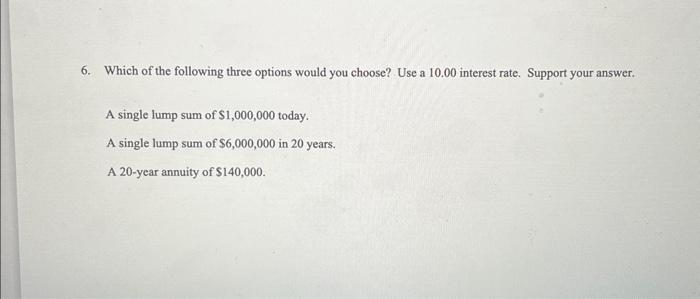

1. Compute the Future Value of a $12,000 investment that will earn 13.50 percent compounded monthly over 8 years. 2. Compute the Present Value of a 20-year annuity due that pays $25,000 per year. Assume a discount rate of 8.00 percent. 3. Your investment advisor recommends a project that guarantees a 12.00 percent rate of return. How long will it take for your investment to double in value? 4. RCB Bank pays depositors 12.75 percent compounded semi-annually. FLA Bank pays 7.25 percent compounded monthly. Which bank would you prefer? Support your answer. Hint: Solve for each bank's Effective Rate (EAR) 5. The cost of capital is 8% for both projects. a. Calculate NPV for each project. b. Calculate IRR for each project. c. If projects A and B are independent, which project(s), if any, would you accept? Why? d. If projects A and B are mutually exclusive, which project(s), if any, would you accept? Why? 6. Which of the following three options would you choose? Use a 10.00 interest rate. Support your answer. A single lump sum of $1,000,000 today. A single lump sum of $6,000,000 in 20 years. A 20-year annuity of $140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts