Question: Please show how to solve in excel if possible! Thanks 3. Pickle Enterprises is considering purchasing new machinery that has a purchase price of $385,000

Please show how to solve in excel if possible! Thanks

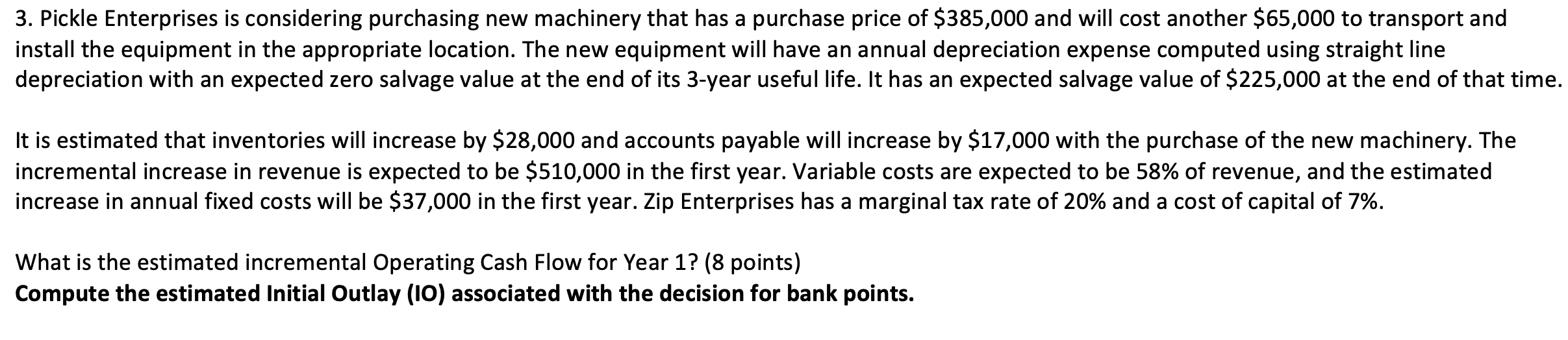

3. Pickle Enterprises is considering purchasing new machinery that has a purchase price of $385,000 and will cost another $65,000 to transport and install the equipment in the appropriate location. The new equipment will have an annual depreciation expense computed using straight line depreciation with an expected zero salvage value at the end of its 3-year useful life. It has an expected salvage value of $225,000 at the end of that time. It is estimated that inventories will increase by $28,000 and accounts payable will increase by $17,000 with the purchase of the new machinery. The incremental increase in revenue is expected to be $510,000 in the first year. Variable costs are expected to be 58% of revenue, and the estimated increase in annual fixed costs will be $37,000 in the first year. Zip Enterprises has a marginal tax rate of 20% and a cost of capital of 7%. What is the estimated incremental Operating Cash Flow for Year 1? (8 points) Compute the estimated Initial Outlay (10) associated with the decision for bank points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts