Question: please show how to solve the problem through excel Cost of common stock equity Ross Textiles wishes to measure its cost of common stock equity.

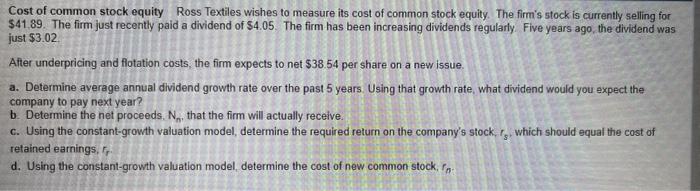

Cost of common stock equity Ross Textiles wishes to measure its cost of common stock equity. The firm's stock is currently selling for $41,89. The firm just recently paid a dividend of $4.05. The firm has been increasing dividends regularly Five years ago, the dividend was just $3.02 After underpricing and flotation costs, the firm expects to net $38.54 per share on a new issue. a. Determine average annual dividend growth rate over the past 5 years. Using that growth rate, what dividend would you expect the company to pay next year? b. Determine the net proceeds, Nn, that the firm will actually receive. c. Using the constant-growth valuation model, determine the required return on the company's stock, rs, which should equal the cost of retained earnings, rr. d. Using the constant-growth valuation model, determine the cost of new common stock, rn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts