Question: Please show how to solve these problems In its second year of operation, Painter Inc. noticed possible theft of its inventories. It gathered the following

Please show how to solve these problems

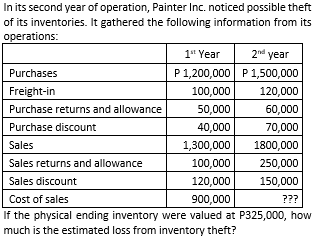

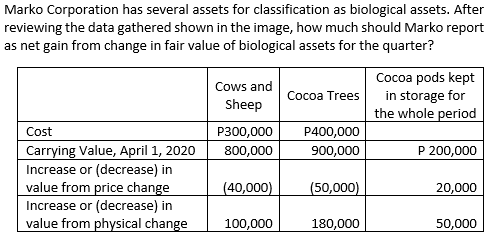

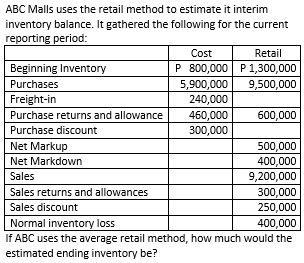

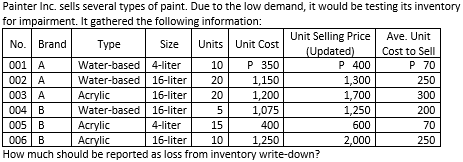

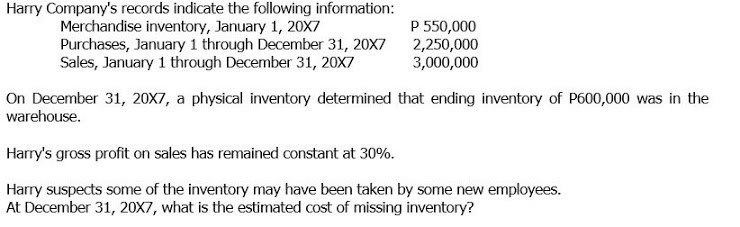

In its second year of operation, Painter Inc. noticed possible theft of its inventories. It gathered the following information from its operations: 1" Year 2" year Purchases P 1,200,000 P 1,500,000 Freight-in 100,000 120,000 Purchase returns and allowance 50,000 60,000 Purchase discount 40,000 70,000 Sales 1,300,000 1800,000 Sales returns and allowance 100,000 250,000 Sales discount 120,000 150,000 Cost of sales 900,000 ??? If the physical ending inventory were valued at P325,000, how much is the estimated loss from inventory theft?Marko Corporation has several assets for classification as biological assets. After reviewing the data gathered shown in the image, how much should Marko report as net gain from change in fair value of biological assets for the quarter? Cocoa pods kept Cows and Cocoa Trees in storage for Sheep the whole period Cost P300,000 P400,000 Carrying Value, April 1, 2020 800,000 900,000 P 200,000 Increase or (decrease) in value from price change (40,000) (50,000) 20,000 Increase or (decrease) in value from physical change 100,000 180,000 50,000ABC Malls uses the retail method to estimate it interim inventory balance. It gathered the following for the current reporting period: Cost Retail Beginning Inventory P 800,000 P 1,300,000 Purchases 5,900,000 9,500,000 Freight-in 240,000 Purchase returns and allowance 460,000 600.000 Purchase discount 300,000 Net Markup 500,000 Net Markdown 400 000 Sales 9,200,000 Sales returns and allowances 300,000 Sales discount 250,000 Normal inventory loss 400 000 If ABC uses the average retail method, how much would the estimated ending inventory be?Painter Inc. sells several types of paint. Due to the low demand, it would be testing its inventory for impairment. It gathered the following information: Unit Selling Price Ave. Unit No. Brand Type Size Units Unit Cost (Updated) Cost to Sell 001 A Water-based 4-liter 10 P 350 P 400 P 70 002 A Water-based 16-liter 20 1,150 1,300 250 003 A Acrylic 16-liter 20 1,200 1,700 300 004 B Water-based 16-liter 5 1,075 1,250 200 005 B Acrylic 4-liter 15 400 600 70 006 B Acrylic 16-liter 10 1,250 2,000 250 How much should be reported as loss from inventory write-down?Harry Company's records indicate the following information: Merchandise inventory, January 1, 20X7 P 550,000 Purchases, January 1 through December 31, 20X7 2,250,000 Sales, January 1 through December 31, 20X7 3,000,000 On December 31, 20X7, a physical inventory determined that ending inventory of P600,000 was in the warehouse. Harry's gross profit on sales has remained constant at 30%. Harry suspects some of the inventory may have been taken by some new employees. At December 31, 20X7, what is the estimated cost of missing inventory