Question: Please show how to solve these problems ON PAPER, NOT WITH EXCEL QUESTION 11 Frasier Cabinets wants to maintain a growth rate of 5 percent

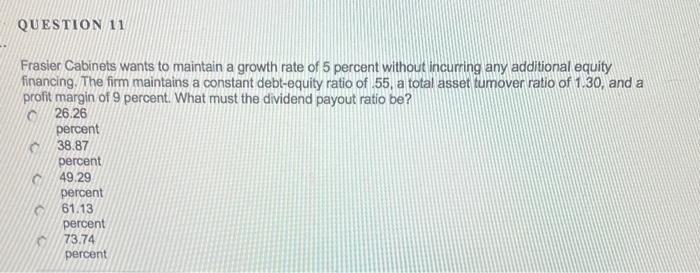

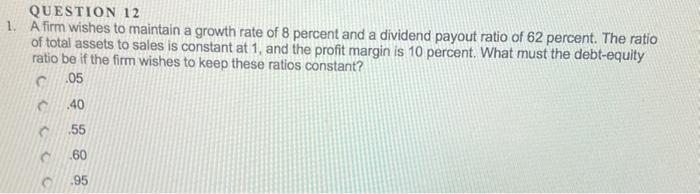

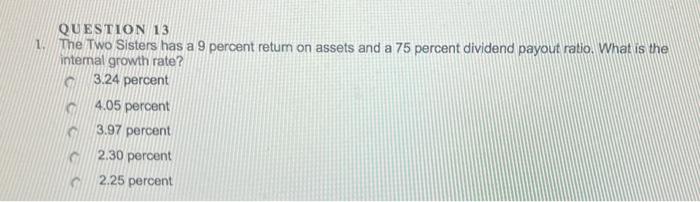

QUESTION 11 Frasier Cabinets wants to maintain a growth rate of 5 percent without incurring any additional equity financing. The firm maintains a constant debt-equity ratio of 55, a total asset tumover ratio of 1.30, and a profit margin of 9 percent. What must the dividend payout ratio be? 26.26 percent 38.87 percent C 49.29 percent 61.13 percent 73.74 percent QUESTION 12 1. A firm wishes to maintain a growth rate of 8 percent and a dividend payout ratio of 62 percent. The ratio of total assets to sales is constant at 1, and the profit margin is 10 percent. What must the debt-equity ratio be if the firm wishes to keep these ratios constant? C.05 .40 55 60 .95 QUESTION 13 The Two Sisters has a 9 percent retum on assets and a 75 percent dividend payout ratio. What is the intemal growth rate? 3.24 percent 4.05 percent 3.97 percent 2.30 percent 2.25 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts