Question: please show how to solve this step by step You take a $6000 long position in the Bank of America stock and a $4000 short

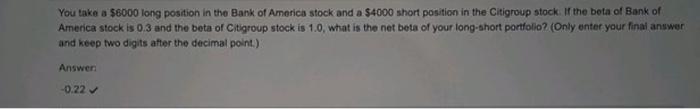

You take a $6000 long position in the Bank of America stock and a $4000 short position in the Citigroup stock. If the beta of Bank of America stock is 0.3 and the beta of Citigroup stock is 1.0, what is the net beta of your long-short portfolio? (Only enter your final answer and keep two digits after the decimal point.) Answer: 0.22v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts