Question: Please show how to use @risk simulation to complete the problem, I need to be able to do in excel i maximizing per expected book.

Please show how to use @risk simulation to complete the problem, I need to be able to do in excel

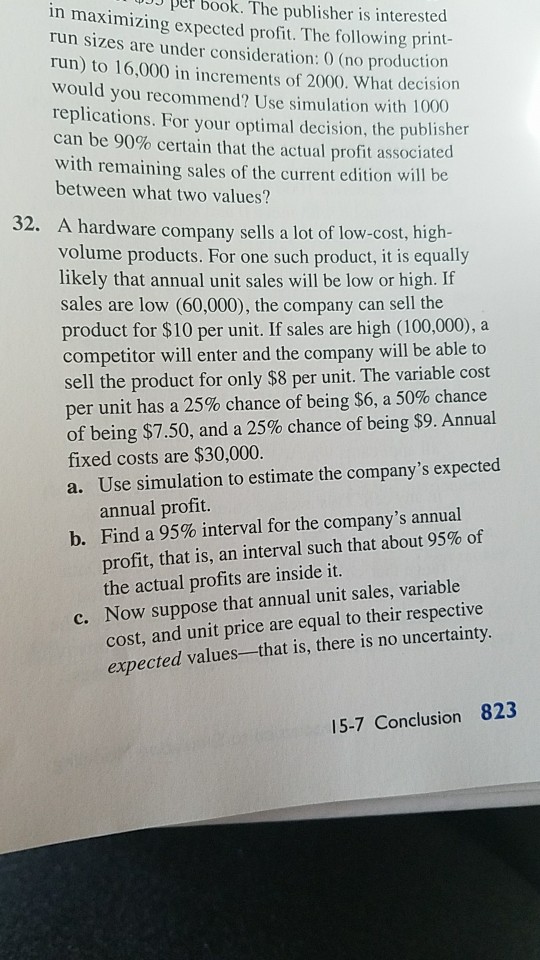

i maximizing per expected book. The publisher is interested proft. T hetolowr run sizes are under consideration: 0 (no productio run) to 16,000 in increments of 2000. What decision would you recommend? Use simulation with 1000 replications. For your optimal decision, the publisher can be 90% certain that the actual profit associated with remaining sales of the current edition will be between what two values? 32. A hard ware company sells a lot of low-cost, high- volume products. For one such product, it is equally likely that annual unit sales will be low or high. If sales are low (60,000), the company can sell the product for $10 per unit. If sales are high (100,000), a competitor will enter and the company will be able to sell the product for only $8 per unit. The variable cost per unit has a 25% chance of being $6, a 50% chance of being $750, and a 25% chance of being $9. Annual fixed costs are $30,000. a. Use simulation to estimate the company's expected annual profit. Find a 95% interval for the company's annual profit, that is, an interval such that about 95% of the actual profits are inside it. cost, and unit price are equal to their respective expected values-that is, there is no uncertainty. c. Now suppose that annual unit sales, variable 15-7 Conclusion 823

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts