Question: Please show how to work out problems thank you. Risk-adjusted discount rates: Basic Country Wallpapers is considering investing in one of three mutually exclusive projects,

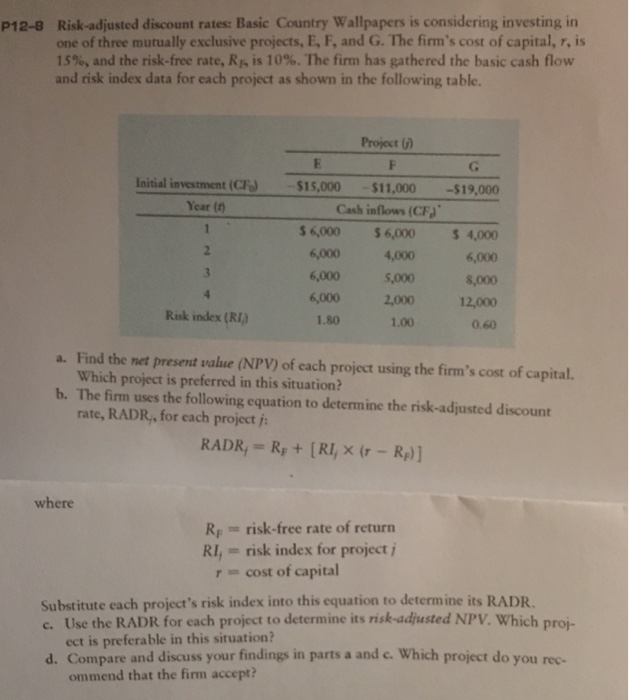

Risk-adjusted discount rates: Basic Country Wallpapers is considering investing in one of three mutually exclusive projects, E, F, and G. The firm's cost of capital, r, is 15%, and the risk-free rate, R_F is 10%. The firm has gathered the basic cash flow and risk index data for each project as shown in the following table. RADR_t = R_F + [Rl_i times (r - R_F)] R_F = risk-free rate of return Rl_f = risk index for project i r = cost of capital Substitute each project's risk index into this equation to determine its RADR. Use the RADR for each project to determine its risk-adjusted NPV. Which project is preferable in this situation? Compare and discuss your findings in parts a and c. Which project do you recommend that the firm accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts