Question: Please show how you get the answer. Thanks! Problem 5-55 (LO. 3) How does the tax benefit rule apply in the following cases? a. In

Please show how you get the answer. Thanks!

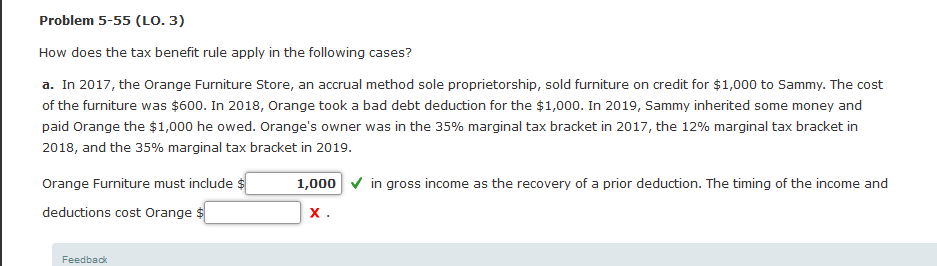

Problem 5-55 (LO. 3) How does the tax benefit rule apply in the following cases? a. In 2017, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2018, Orange took a bad debt deduction for the $1,000. In 2019, Sammy inherited some money and paid Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2017, the 12% marginal tax bracket in 2018, and the 35% marginal tax bracket in 2019. in gross income as the recovery of a prior deduction. The timing of the income and Orange Furniture must include $ deductions cost Orange $ 1,000 x Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts